In a recent post I reviewed how asset allocation is a reliable tool for earning average to above-average returns (with average or below-average risk) for a given opportunity set. Let’s extend the concept with a real-world test of three more market slices: US fixed income, US equity sectors and US equity risk factors.

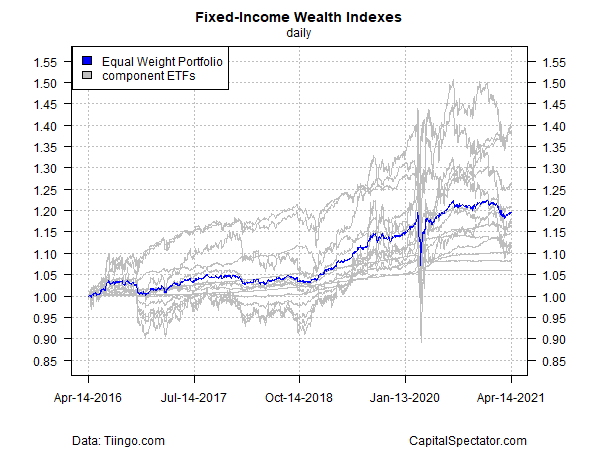

First up is fixed income, based on this set of bond ETFs to proxy a wide sample of US fixed income. For the test period we’ll look at the trailing five-year window. Once again, the value of allocating assets (using equal weights that are rebalanced every Dec. 31) is clear. In particular, notice that the equal-weighted mix is relatively stable and delivers roughly average results.

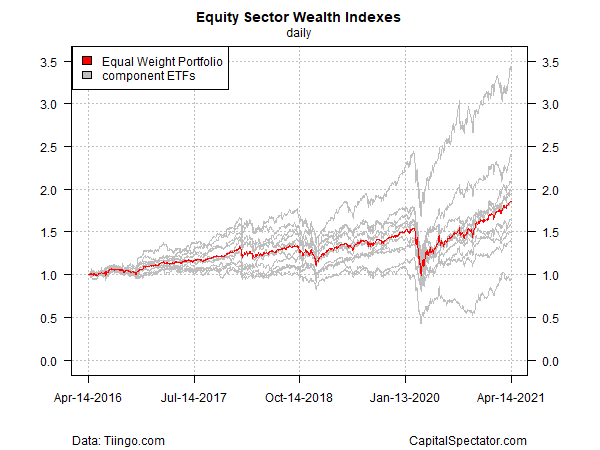

For equity sector ETFs, I used this fund set. Here, too, we see a familiar outcome: average results.

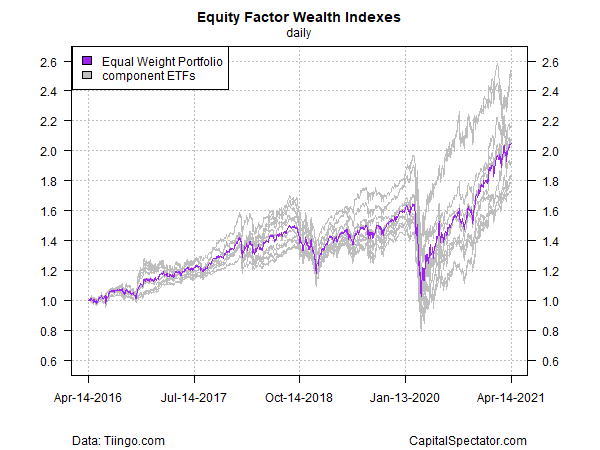

Next, here’s the equity factor test, based on a broad set of representative ETFs.

The common theme: asset allocation across a representative set of funds within a given markets space delivers a dependable strategy for earning average-to-above-average performance while keeping risk under control, typically at an average level if not below average.

The relatively consistent return and risk-management outcomes of holding everything and equal weighting (or cap weighting) lays a foundation for enhancing the results further by adding, say, a momentum overlay for adjusting weights tactically with an eye on juicing return a bit and/or lowering risk.

In an upcoming post I’ll look at some of the possibilities.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.