Morgan Stanley identifies next wave of AI-linked "alpha"

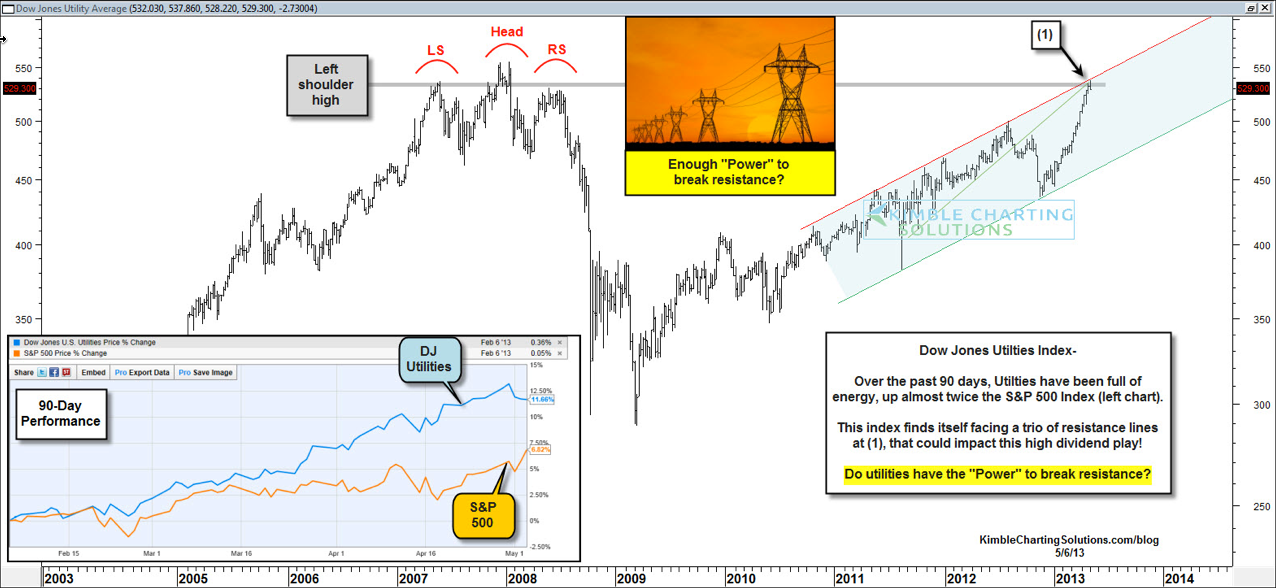

Have utilities helped power the S&P 500 index higher of the past 90 days? Above my pay grade. Investors for sure have been seeking high-yielding stocks and ETF's and utilities have been a beneficiary of those inflows. Is anyone surprised that the S&P 500 is at all-time highs and that boring utilities have almost doubled (see lower left inset chart) the SPY's performance over the past 90 days?

The DJ Utilities index is now facing a trio of resistance in the chart above at (1). Do utilities still have the "power" to break this resistance? A break above the trio of resistance would be good for this index and the SPY.

If you are seeking high-yielding stocks, how the DJ Utilities index handles this resistance could be very important to your holdings.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI