What’s wrong with the housing market?

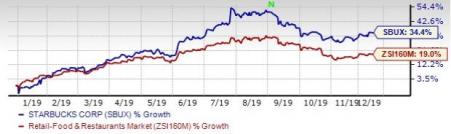

In an intensely competitive restaurant landscape, Starbucks Corporation (NASDAQ:SBUX) has done exceedingly well. This is quite evident from the stock’s performance in 2019. Year to date, the stock has surged 34.4% compared with the industry’s 19% growth.

Starbucks’ solid execution of several initiatives in the United States and China along with best-in-class loyalty programs and digital offerings are driving the company’s performance. However, contraction in operating margin and soft Channel Development sales remain a concern. Let’s delve deeper.

Growth Drivers

Starbucks continues to benefit from robust performance by the Americas and China-Asia-Pacific segments, store openings, enhanced customer experience and digitalization. In the United States and China, the company witnessed strong demand for its new beverages. Moreover, the company’s strategic efforts helped it to bring back traffic growth. Traffic, which declined in the first half of 2019, improved in the third and fourth quarter.

China Asia Pacific or CAP has now become the fastest growing segment. Notably, improving customer experience via innovative new store designs, up-leveling product offerings and margin expansion through process and supply chain efficiencies are driving CAP performance. China has witnessed comps growth of 1%, 3%, 6% and 5% in the first, second, third and fourth of fiscal 2019, respectively. Management believes that China and the Asia-Pacific region will drive business growth over the next five years supported by rapid unit growth, growing brand awareness, and increased usage of the digital/mobile/loyalty platforms.

Furthermore, Starbucks has announced a historic partnership with Alibaba (NYSE:BABA) for providing seamless Starbucks Experience to drive growth in China. Starbucks began delivery services in Beijing and Shanghai via Alibaba's Ele.me platform.

These apart, the company’s robust loyalty program is attracting customers. Starbucks holds a leading position in digital, card, loyalty and mobile capabilities. Its loyalty cards are also gaining popularity. In the United States, the company’s membership increased 11% year over year under the My Starbucks Rewards (MSR) program in fiscal 2017 and rose 15% as well to 15.3 million active members in fiscal 2018. The momentum continued in 2019, with the membership improving 15% year over year to 17.6 million active members. Moreover, this loyalty program, launched in December 2018, in China, had total of 10 million members at the end of fourth-quarter fiscal 2019, improving by 45% year over year.

With significant innovation across beverages, refreshment, health and wellness, tea and core food offerings, Starbucks is strengthening its product portfolio. The company is leaning toward fast-growing categories like Cold Brew, Draft Nitro beverages, and plant-based modifiers, including almond, coconut, and soy milk alternatives.

Concerns

Channel Development is another segment that has disappointed investors. Sales at the segment have declined for the fifth straight quarter. In fourth-quarter fiscal 2019, net revenues at this segment decreased 6% to $508.1 million, following a decline of 6% in third-quarter fiscal 2019.

Margin contraction has been an added concern. In the first, second, third and fourth quarter of fiscal 2018, Starbucks non-GAAP operating margin shriveled 170, 80, 230 and 190 bps, respectively. The downtrend continued in first, second, third and fourth-quarter fiscal 2019, with margin declining 180, 40, 20 and 80 bps year over year to 17.4%, 15.8%, 18.3% and 17.2%, respectively. The impact of from streamline-driven activities, U.S. tax reform-funded investments, Siren Retail and onetime investment in the Chicago leadership conference resulted in the downturn in fourth-quarter fiscal 2019. Rise in costs due to investment in digitalization also dented the company’s operating margin.

Zacks Rank & Key Picks

Starbucks currently has a Zacks Rank #3 (Hold). Better-ranked stocks, worth considering in the same space, include El Pollo Loco Holdings, Inc. (NASDAQ:LOCO) , Chipotle Mexican Grill, Inc (NYSE:CMG) and Brinker International, Inc. (NYSE:EAT) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

El Pollo Loco Holdings has an expected long-term earnings growth rate of 10%.

Chipotle Mexican Grill reported better-than-expected earnings in each of the trailing four quarters, the average being 16.1%.

Brinker International has an expected long-term earnings growth rate of 7.7%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Brinker International, Inc. (EAT): Free Stock Analysis Report

Starbucks Corporation (SBUX): Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO): Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.