Salesforce.com (N:CRM) Information Technology - Software | Reports February 24, After Market Closes.

Key Takeaways:

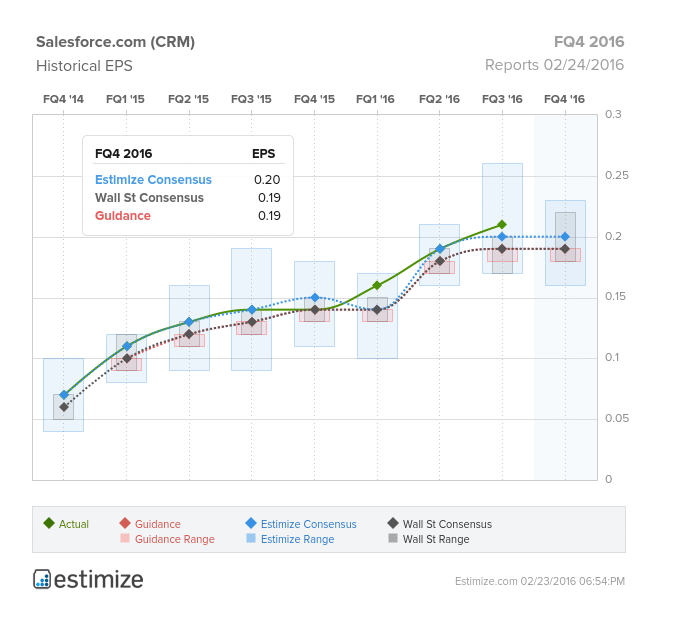

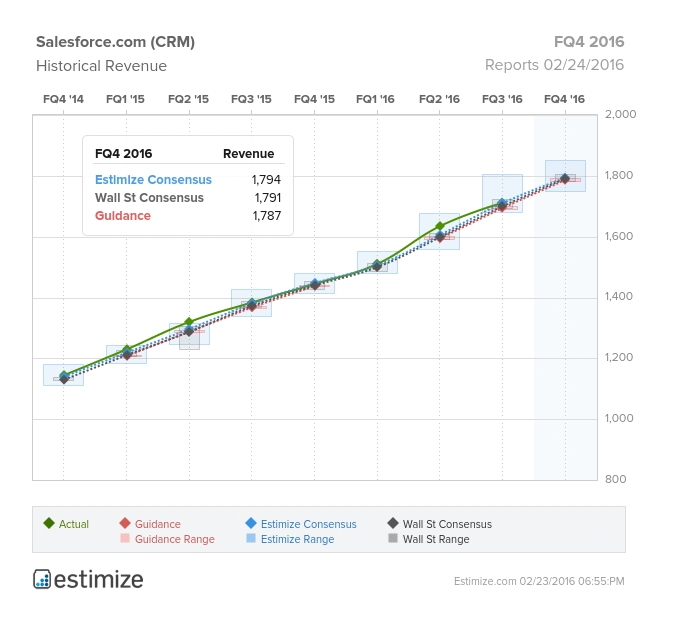

- The Estimize consensus is calling for EPS of $0.20 and revenue of $1.794 billion, slightly higher than Wall Street consensus EPS and revenue estimates of $0.19 and $1.791 billion, respectively

- Salesforce’s shares have plunged 19% in the past year as competitive threats from Microsoft (O:MSFT), Oracle (N:ORCL) and Amazon (O:AMZN) grow

- M&A activity has helped Salesforce expand, but has also put pressure on the company’s margins and cash flow.

Salesforce.com, the market leader in CRM systems, will report its fourth quarter earnings February 24, after the market closes. After a strong 2015 where shares surged 30%, the company has started the year off to a slow start. Salesforce has fallen victim to the weakness plaguing enterprise technology. Investors have been wary of whether these companies can maintain their rapid growth rates moving forward.

Salesforce is coming off a better than expected third quarter, reporting a double digit positive earnings surprise. The company has consistently beat Wall Street on the top line, positing 8 consecutive quarters of revenue growth. This quarter, the Estimize consensus is calling for EPS of $0.20, 1 cent higher than Wall Street, and revenue expectations of 1.794 billion, roughly $3 million higher than the Street. Compared to the same period last year this represents a projected YoY increase in EPS and revenue of 44% and 24%, respectively. Yet, competitive threats from competitors have put pressure on Salesforce’s bottom line.

Despite not selling its own CRM software, Amazon is a legitimate threat to Salesforce’s growth. Amazon has struck partnerships with CRM solutions companies who offer its services via Amazon Web Services (AWS). Salesforce currently controls a leading 18% in market share with Microsoft, Oracle, and Amazon slowly creeping up behind.To maintain its industry lead, Salesforce has pursued strategic acquisitions to bolster its digital marketing solutions and in-house technology.

The fourth quarter is expected to benefit from the success of popular products such as Salesforce ExactTarget Marketing Cloud platform and the recently launched Salesforce1 Customer Platform. Salesforce is also making a play for social, launching a new set of tools to help marketers engage with customers on Instagram by using their suite of Marketing Cloud products. The most important number to watch for is Salesforce’s is their backlog of booked business which increased 28% YoY in the latest quarter.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.