The Home Depot (NYSE:HD)

Consumer Discretionary - Specialty Retail | Reports August 16, Before Market Opens

Key Takeaways

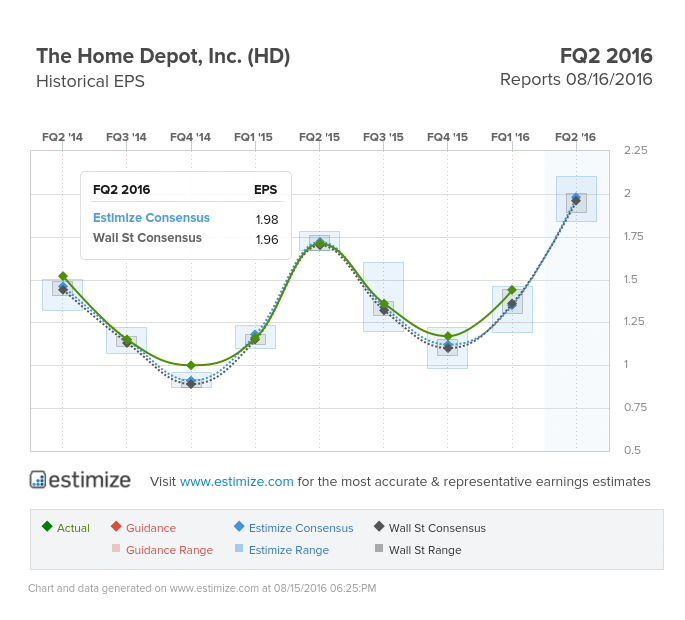

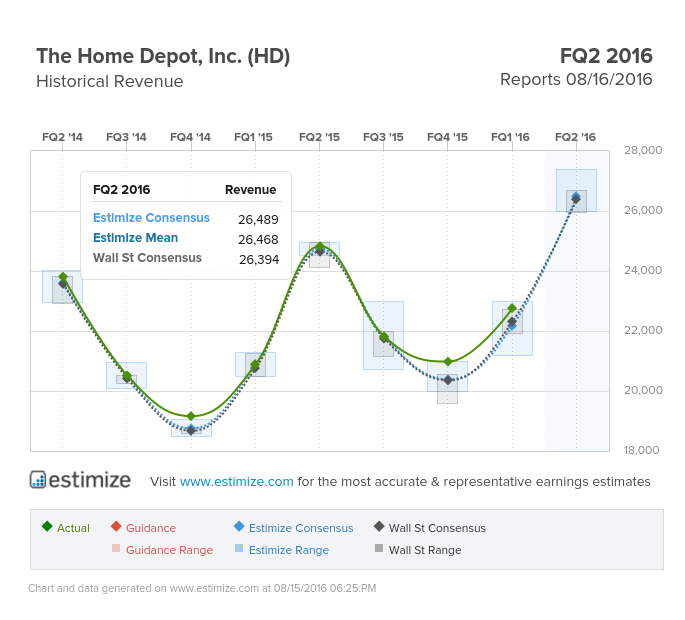

- The Estimize consensus is calling for earnings per share of $1.98 on $26.49 billion in revenue, 2 cent higher than Wall Street on the bottom line and $100 million on the top

- The ongoing housing recovery coupled with several strategic initiatives have put Home Depot on the path to success

- Shares are up 17% in the past 12 months but have fared poorly since the start of 2016

Home Depot is prepared to announce its second quarter results early tomorrow morning. The home improvement retailer has outperformed the Estimize consensus in each of the past 3 quarters. That streak extends to 8 consecutive quarters when compared to Wall Street’s expectations. The broader recovery in the housing market and focus on improving customer experience have been key to Home Depot’s recent streak. With new and existing home sales making further strides, don’t expect earnings to falter in the upcoming report.

Analysts at Estimize are looking for earnings per share of $1.98, 15% higher than the same period last year. That estimate has increased by 1% in the past month. Revenue is anticipated to come in 6% greater at $26.49 billion, consistent with the high single digit growth of the last 2 years. Investors should expect to see a small pop after the company reports. Typically the stock increases 2% immediately following a report. Shares of Home Depot are currently up 17% in the past 12 months, but haven’t fared as well in 2016.

Low interest rates can be largely credited with the broader housing recovery since the financial crisis. As home sales steadily improve that will continue to drive traffic trends. Not only does Home Depot benefit from an increase in new home sales, but as home prices stay high, consumers tend to invest heavily into their properties. Strong job growth has also supported this ongoing trend, allowing consumers to spend on home improvement projects.

Home Depot is also putting forward strategic initiatives to drive sales. In response to the evolving retail environment, Home Depot is diligently devoting resources to its ecommerce platform. Last quarter online sales growth topped 21%, consistent with the double digit gains in previous quarters. A majority of online sales are typically picked up in stores which promote in-store sales.

As a retailer, Home Depot still faces significant risks in terms of competition and deeper penetration from Amazon (NASDAQ:AMZN). Lowe’s is likely the company’s largest threat but is still well behind them in terms of market share.

Do you think HD can beat estimates?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.