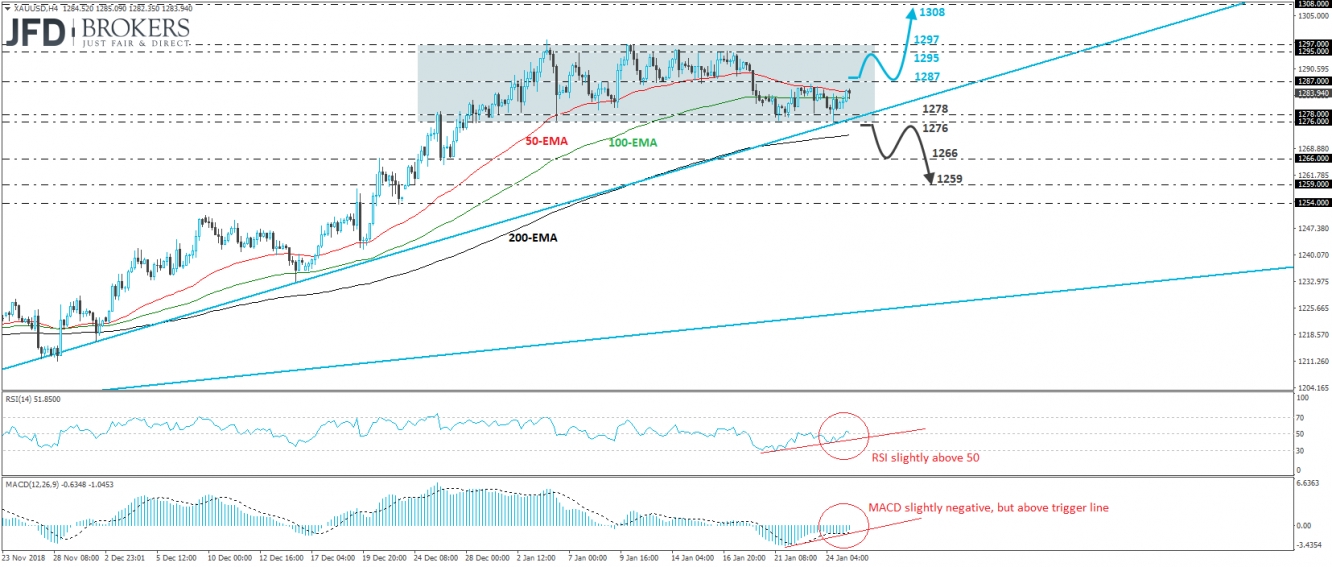

XAU/USD traded higher on Friday, after it hit support near the uptrend line drawn from the low of the 14th of November on Thursday. Since the 28th of December, the precious metal has been trading in a sideways mode between 1276 and 1297, and thus we would consider the short-term picture to be neutral for now. That said, bearing in mind that the price holds on above the aforementioned upside line, we see the case for some further recovery for now, at least towards the upper bound of the range.

At the time of writing, the metal trades slightly below the 1287 resistance zone, the break of which may pave the way towards the 1295 level, or the upper end of the recent short-term sideways range, at around 1297. However, a clear and decisive break above that hurdle is needed before we get more confident on the resumption of the prevailing uptrend. Such a move may encourage the bulls to put the 1308 territory on their radars. That zone acted as a good resistance on May 25 and June 14.

Taking a look at our short-term momentum studies, we see that the RSI emerged slightly above 50 and turned somewhat down again, but still stays above its respective upside support line. The MACD, although negative, lies above its trigger line and looks to be heading towards zero. It could obtain a positive sign soon. These indicators support somewhat the notion for some more recovery in the yellow metal, at least towards the upper bound of the abovementioned sideways path.

On the downside, we would like to see a clear dip below 1276, the lower end of the range, before we start examining whether the bears have gained the upper hand, at least in the short run. Such a break could also confirm the break of the uptrend line taken from the low of November 14 and may initially pave the way for the 1266 support obstacle. Another move lower, below 1266, may extend the slide towards our next potential area of support, at around 1259, defined by an intraday low formed on December 24.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI