Costco Wholesale Corporation (NASDAQ:COST)

Consumer Staples - Food & Staples Retailing | Reports March 2, After Market Close

Key Takeaways:

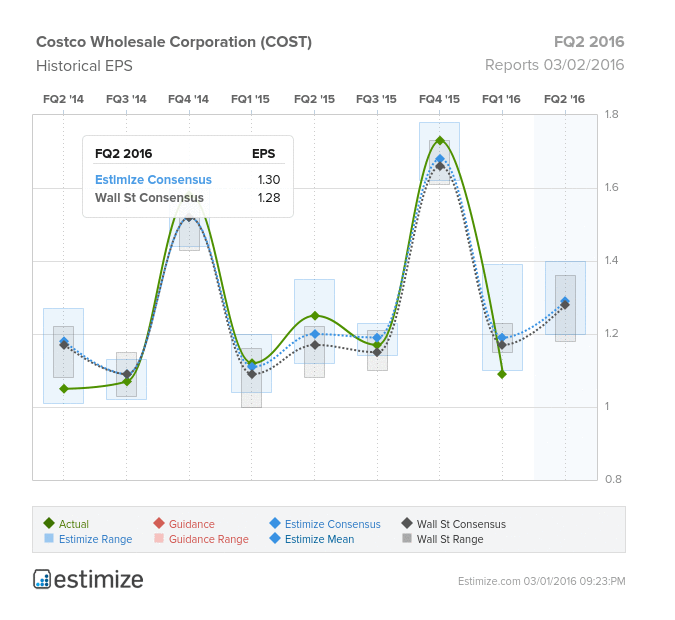

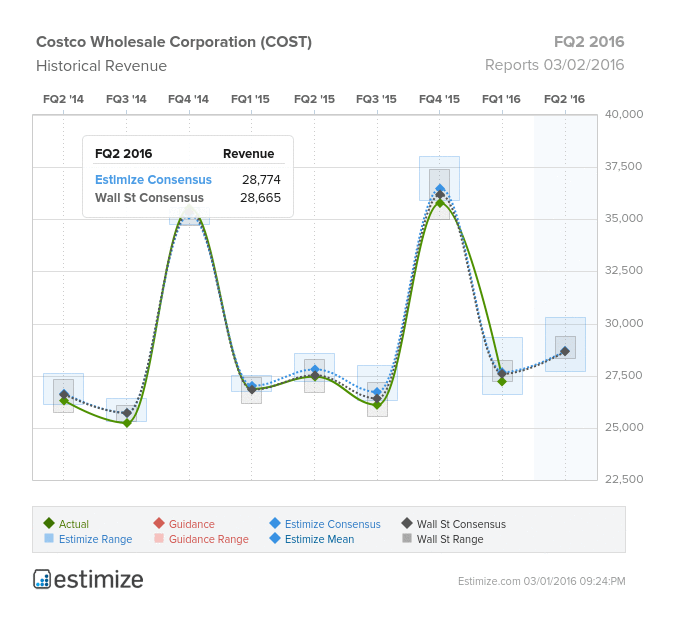

- The Estimize community is calling Costco (COST) to show an EPS of $1.30 and revenue of $28.774 billion, surpassing Wall Street by 2 cent on the bottom line and $110 million in sales

- FX headwinds, low gas prices and slow membership growth are expected to cut into comparable store sales

- Inclement weather caused warehouse sales to fall 1% and total sales to dip and total 0.75%.

Beloved warehouse retailer Costco is scheduled to report FQ2 2016 earnings March 2, after the market closes. Last quarter the company missed on both the top and bottom line, largely due to weak same store sales and currency headwinds. Given the company’s remarkable fiscal 2015, this most recent quarter came as a surprise to the Costco faithful. Consequently, shares have fallen 7.30% since they last reported, despite the generally high sentiment towards Costco’s long term prospects.

This quarter the Estimize community is calling for EPS of $1.30 and revenue of $28.774 billion, surpassing Wall Street by 2 cent on the bottom line and $110 million in sales. However, our Select Consensus, which more heavily weights historically accurate analysts and recent estimates, is expecting a more modest beat of 1 cent. Compared to the same period last year, this predicts as a 4% increase on the bottom line while sales are expected to grow 5%. Costco has been consistently unable to beat expectations, only eclipsing the Estimize consensus in 41% of quarters.

On a constant currency basis, comparable store sales are expected to rise by a 3%. Meanwhile, Costco has targeted 30 new warehouse openings across the U.S. and internationally during fiscal 2016. That said, a strong U.S. dollar, on top of the struggling oil sector, is predicted to take its toll on quarterly earnings. Any positive sales trends overseas will almost certainly be squashed as long as weaker spending and macroeconomic headwinds persist.

Costco recently announced sales figures for January with net sales reaching $8.6 billion, up 2% the same period a year ago. While this is encouraging, management claims the winter storms that affected the Midwest and Northeast caused warehouse sales to fall 1% and total sales to fall 0.75%.

Additionally, membership revenues are projected to hit a wall. Costco prides itself on its loyal member base which boasts a resounding 91% membership renewal rate. However, the switch from Amex to Visa has taken longer than expected, leaving prospective customers patiently waiting. This has caused the retailer to temporarily suspend a new private label card signup with Citibank until a fee is agreed upon for Amex’s Costco credit portfolio.

Ultimately, the switch to Visa is beneficial in the long run, but these hiccups are having an adverse impact in the near term.

Do you think COST can beat estimates?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.