Ulta Salon Cosmetics & Fragrance (NASDAQ:ULTA)

Consumer Discretionary - Specialty Retail | Reports May 26, After Market Closes

Key Takeaways

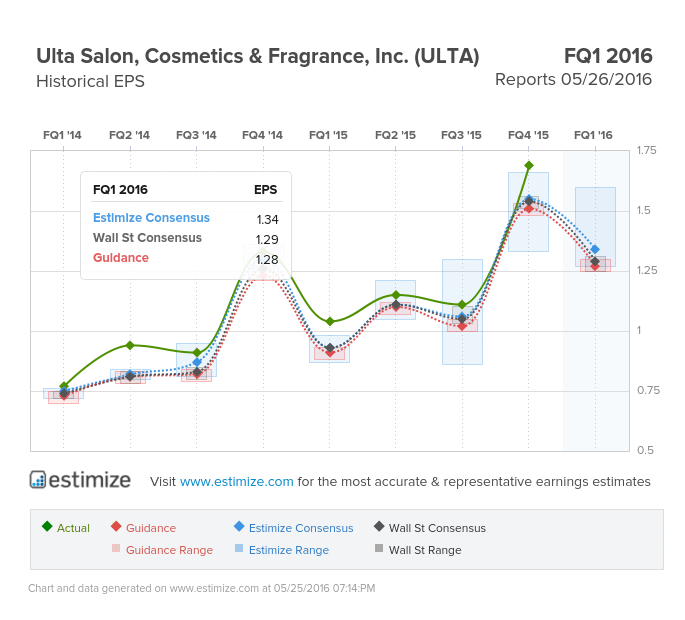

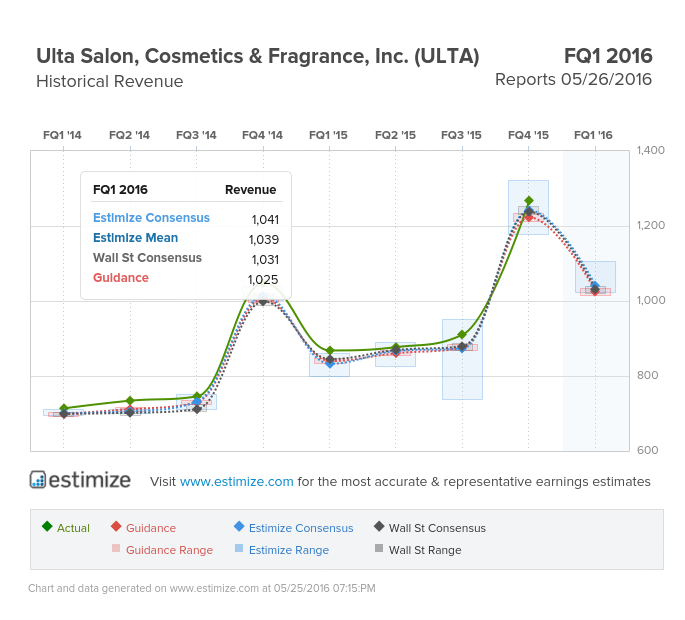

- The Estimize consensus is looking for earnings per share of $1.34 on $1.04 billion in revenue, 5 cents higher than Wall Street on the bottom line and $10 million on the top

- Overall in Q4 2015, online sales grew 44.2% sustained by effective use of targeted emails and promotions

- Ulta’s market position, strategic outlook, and burgeoning cosmetics and beauty care products should be enough to mask the uncertainty in its sluggish fragrances segment.

Despite the current slump for apparel and accessories retailers, the beauty space remains hot, and tends to be recession proof. Macy’s Inc (NYSE:M) which bought special beauty brand BlueMercury in 2015, and JC Penney Company Inc Holding (NYSE:JCP) which has ramped up their in-store Sephora counters, both reported their respective beauty businesses as some of best performing of all segments in Q1. Ulta should benefit from the same trends that favor skincare and cosmetic offerings.

The Estimize consensus is looking for earnings per share of $1.34 on $1.04 billion in revenue, 5 cents higher than Wall Street on the bottom line and $10 million on the top. Compared to a year earlier this represents a 28% increase in profitability and 20% in sales. Given Ulta has posted double digit gains in 8 consecutive quarters, it’s not surprising that the stock is a positive mover during earnings season. This should be a nice boost for investors who have already seen shares increase 40% in the past 12 months

Ulta is coming off its 9th consecutive quarter of beating on both the top and bottom line. The recent string of strong performances can be attributed to robust online traffic and sales. Overall in Q4 2015, online sales grew 44.2% sustained by effective use of targeted emails and promotions. Last quarter, the beauty products retailer posted a 12.5% increase in comparable sales (stores that have been open at least 14 months and ecommerce) in which retail SSS were up 10.4%. Strength has been driven by an increase in transactions and average ticket price. Salon sales for the company’s in-store hair salons also saw robust growth of 16.7% last quarter, and are expected to be a bright spot again in Q1.

Women’s fragrances were a source of concern in 2015, with the category turning sharply negative. However, Ulta’s market position, strategic outlook, and burgeoning cosmetics and beauty care products should be enough to mask the uncertainty in its sluggish fragrances segment.

Do you think ULTA can beat estimates?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.