F5 Networks Inc (NASDAQ:FFIV) Information Technology - Communications Equipment | Reports April 20, After Market Closes

Key Takeaways

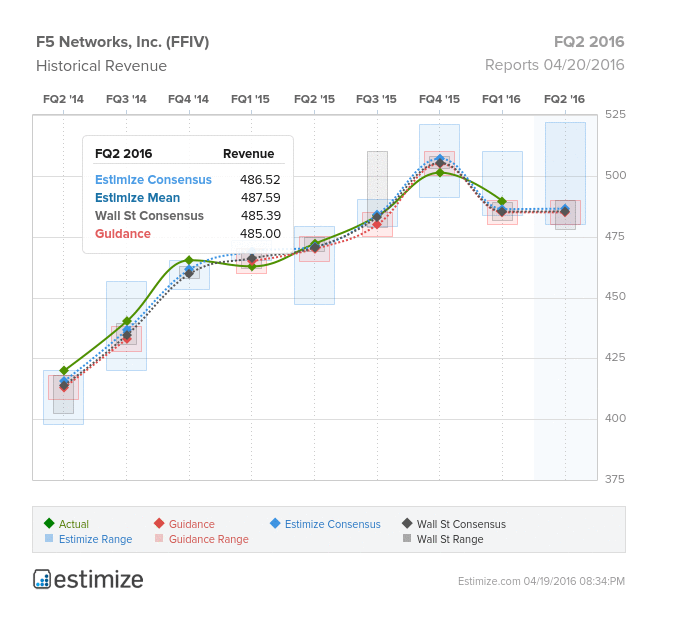

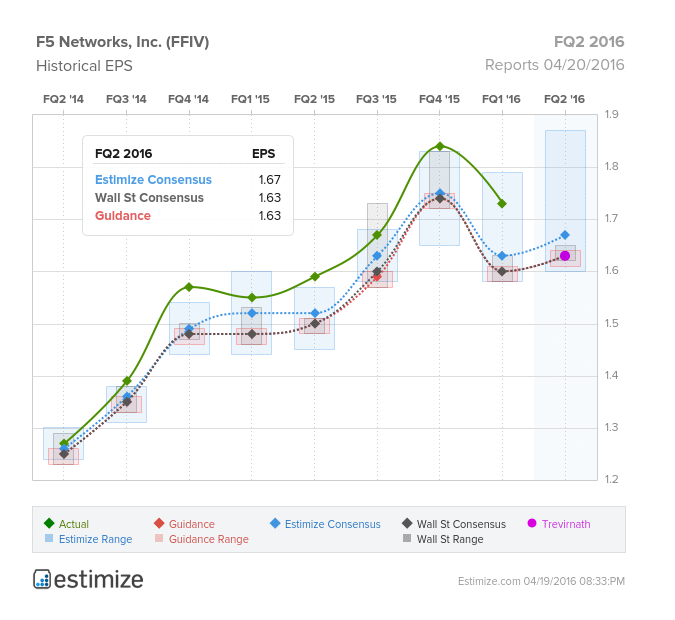

- The Estimize consensus is calling for EPS of $1.67 on $487.59 million in revenue, 4 cents higher than Wall Street on the bottom line and $2 million on top

- F5 Networks is coming off 8 consecutive beats on the bottom line, but the stock is still down 15% in the past 12 months

- With hybrid cloud solutions taking the industry by storm, F5 is seeing waning demand for some of its key products

- What are you expecting for FFIV?

F5 Networks is scheduled to report fiscal second quarter earnings Wednesday, after the market closes. Expectations have been relatively upbeat despite being in the midst of a sluggish enterprise spending environment. The Estimize consensus is calling for EPS of $1.67 on $487.59 million in revenue, 4 cents higher than Wall Street on the bottom line and $2 million on top. However our Select Consensus, a weighted average of our most accurate analyst and recent estimates, is expecting a more modest beat of $1 million on the top. Estimates have come down 3% in the past 3 months on both the top and bottom line. Compared to the year prior, earnings are expecting to grow 5% while sales are looking to increase 3%. Historically, the company’s stock rises 2% through earnings, likely driven by consecutive quarterly beats. Apart from the marginal uptick during earnings season, the stock has performed poorly, falling 17.6% in the past 12 months.

Following strong revenue growth of 11% in fiscal 2015, revenue is expected to increase 5% this year. Mid single digit growth has been driven by a weak enterprise spending environment and ongoing macroeconomic uncertainty. Meanwhile, enterprise technology is rapidly evolving leaving F5 Networks prone to unsold inventory. This has been particularly true with ADC architectures which are slowly losing favor to hybrid cloud solutions. Though F5 could have a role in hybrid architecture, it isn’t something that could happen overnight. Meanwhile, the company faces competitive threats from Citrix and Cisco, which operate in this same space. On the bright side, F5 is seeing revenue growth from key areas such as mobile data, data center products, new security offerings and continued demand from domestic markets.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.