Palo Alto Networks Inc (NYSE:PANW)

Information Technology - Communications Equipment | Reports May 26, After Market Closes

Key Takeaways

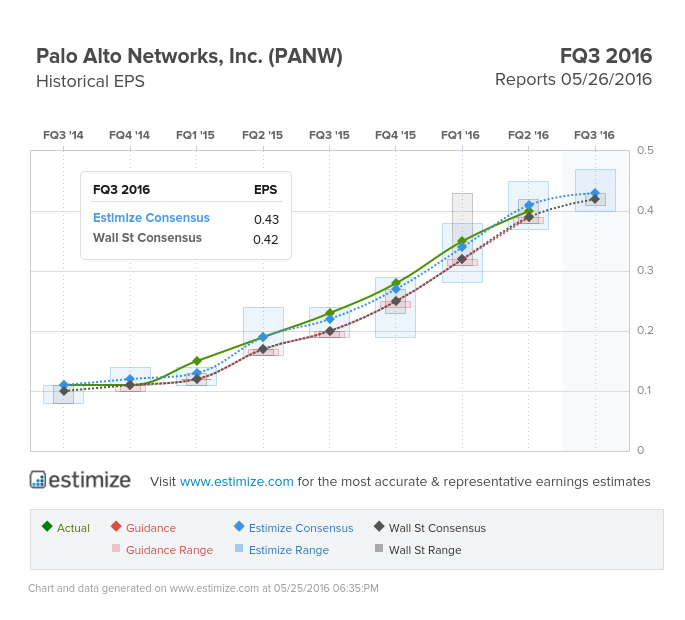

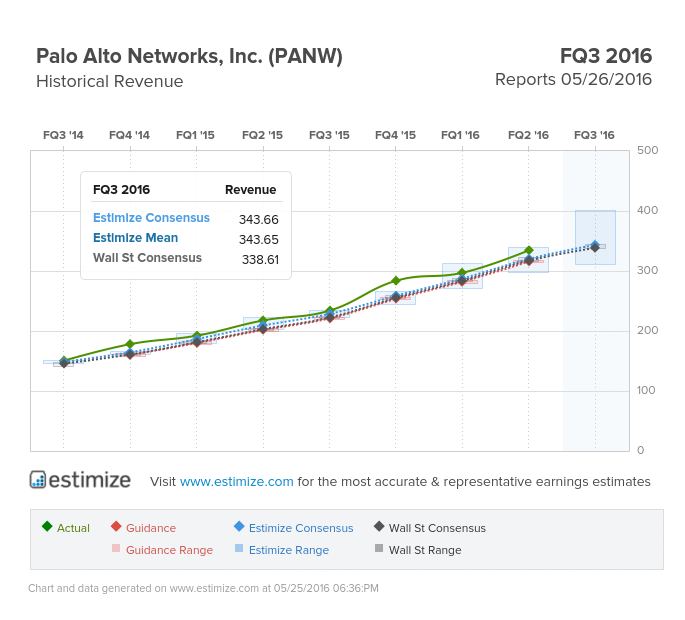

- The Estimize consensus is calling for earnings of 43 cents per share on $343.66 million in revenue, 1 cent higher than Wall Street on the bottom line and $5 million on the top

- In the past four quarters Palo Alto Networks has reported EPS growth of 100% on 50% revenue growth

- The increasingly complex cyber security space, weak IT spending environment and stiff competition poses a significant risk moving forward

The cyber security space has been one of the fastest growing industries as an increasing amount of information becomes stored in the cloud. Many companies have benefited from these trends including Palo Alto Networks Inc (NYSE:PANW), Fortinet Inc (NASDAQ:FTNT), Check Point Software Technologies Ltd (NASDAQ:CHKP) and Fireeye Inc (NASDAQ:FEYE). However there is growing concern whether these companies can sustain high earnings and revenue growth. So far we’ve seen FireEye validate this trend of muted growth with its first quarter results that featured a 2% gain on the bottom line. Tomorrow we get to see if Palo Alto Networks will follow the pack or pave its own path when it reports fiscal third quarter earnings

The Estimize consensus is calling for earnings of 43 cents per share on $343.66 million in revenue,1 cent higher than Wall Street on the bottom line and $5 million on the top. Compared to a year earlier this represents an 88% increase in earnings with sales pegged to grow 47%. Despite the impressive numbers, results have decelerated in the past year. If everything plays out as expected this would be the first quarter in a year with EPS growth and sales growth below 100% and 50%, respectively.

Palo Alto has solidified its status as an industry leading cyber security company. Consistent growth demonstrates the company’s increasing strength from its hybrid SaaS model and strategic partnerships. Last quarter featured a key partnership with Proofpoint while also extending the footprint of its cloud ecosystem. Increasing customer adoption coupled with frequent product updates will help boost revenue moving forward

A significant source of concern in the software security space has arisen by virtue of the tight spending environment and competition from tech giants like Cisco. An increasingly competitive landscape could necessitate PANW to raise its spending on sales and marketing thereby limiting its current margin leverage.

Do you think PANW can beat estimates? There is still time to get your estimate in here!

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI