LinkedIn (NYSE:LNKD) Information Technology - Internet, Software & Services | Reports April 28, After Market Closes

Key Takeaways

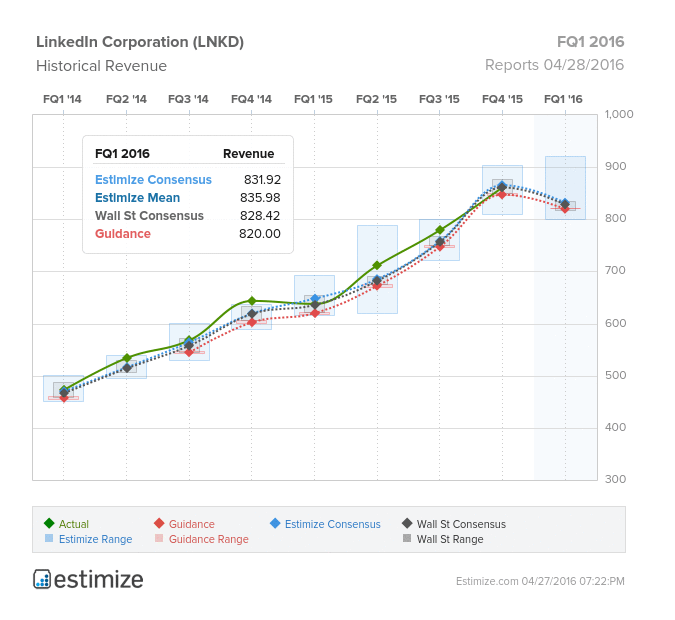

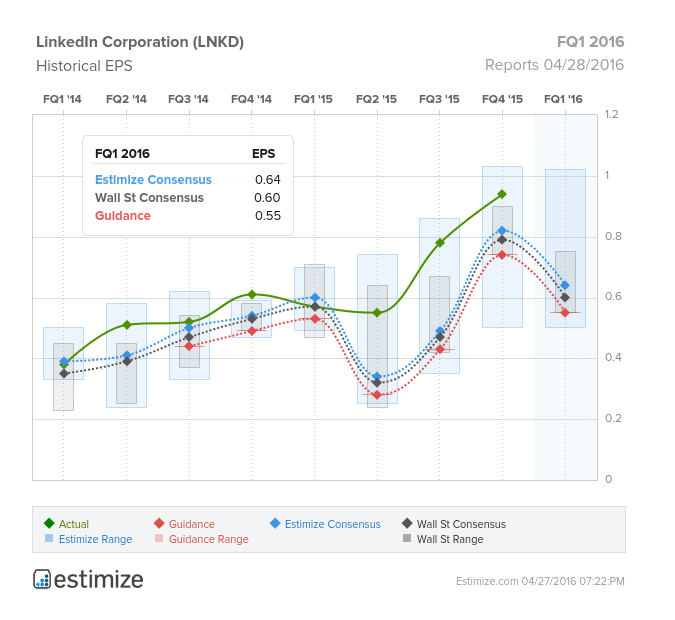

- The Estimize consensus is calling for EPS of $0.64 on $831.92 million in revenue, 4 cents higher than Wall Street on the bottom line and $3 on the top

- Despite strong earnings, weak guidance continues to send the stock tumbling

- LinkedIn is seeing early success in several of its new products including LinkedIn Elevate, Referrals and Lynda.com

Several social media companies are scheduled to report earnings this week. After Twitter Inc (NYSE:TWTR) and Facebook (NASDAQ:FB) comes LinkedIn, which is scheduled to report Q1 earnings on Thursday. The professional network is coming off of 3 consecutive beats on the bottom line and revenue has steadily increased since its debut on the public market. Unfortunately, earnings have not translated to success for the stock. Following Q4 earnings, weak guidance sent shares tumbling over 45% with the stock now down 54.4% from this point last year. The company indicated first quarter earnings would come in closer to $0.55, a significant decrease from the $0.77 Wall Street was initially expecting.

For the first quarter, the Estimize consensus is calling for EPS of $0.64 on $831.92 million in revenue, 4 cents higher than Wall Street on the bottom line and $3 on the top. Compared to a year earlier, profits are forecasted to increase 15% while sales could grow as much as 31%. On average, the stock typically moves around earnings season. Leading into earnings, shares have historically increased, but then tend to drop into negative territory once the company reports.

Unfortunately, for LinkedIn decent growth is not enough to spark a surge in stock prices if forward guidance isn’t positive. LinkedIn’s efforts to get professionals excited about its social network is not paying off as quickly as Wall Street expected. Last quarter, the company reported an increase in member while unique visitors fell flat and member page views dropped.There is also a high probability that Facebook starts to infringe on LinkedIn’s space with the introduction of Facebook at Work. Given Facebook’s success with everything it touches, this could be a huge blow to LinkedIn moving forward. Still, the company is gaining traction across many key areas including its mobile app and geographical footprint.

Do you think LNKD can beat estimates?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.