FY17 saw Caledonia Mining Corporation Plc (TO:CAL) marginally beat its 54-56koz gold production guidance, drive down AISC costs, its head grade increase (which had a corresponding positive effect on gold recoveries) and add significantly to its code-compliant resource base. In relation to its investment plan to lift production to 80koz by 2021, we see capex peaking this financial year (FY18), which will then allow significantly improved free cash flow generation. Coupled with an improved political environment and regulatory changes seemingly favouring gold miners (with a key objective of improving Zimbabwe’s domestic US$ currency supply), Caledonia is very well placed to capitalise on the long-overdue opening up of one of Africa’s prime geological and mining gems.

Production and costs beating guidance

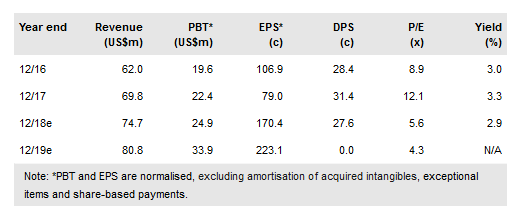

Caledonia produced 56,133oz Au in FY17, a y-o-y increase of 11.4%, at all-in sustaining costs (AISC) of US$847/oz, a y-o-y decrease of 7.1%. This resulted from an improving gold grade (a recent concern of investors, and one which should now be readdressed to the upside as the mine delves deeper into higher-grade resources) and higher tonnes processed from improving milling efficiency.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.