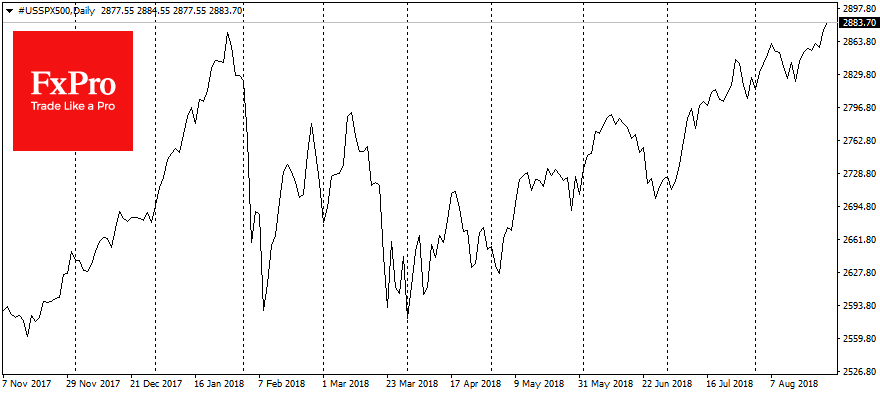

Powell’s tempered comments in Jackson Hole last week supported the growth of U.S. stocks which closed at record highs. Futures on S&P 500 оn trades in Asia continued its historical highs updates, adding another 0.3% from the beginning of the day to levels 2884.5. The growth of American bourses helps Asian markets this Monday morning. Heng Seng 50 adds 1.4% on Monday morning.

In his speech on Friday Powell noted that rates increase will remain gradual. It was also important for markets to hear that the rate hikes are not predetermined, and further path will be data-dependent.

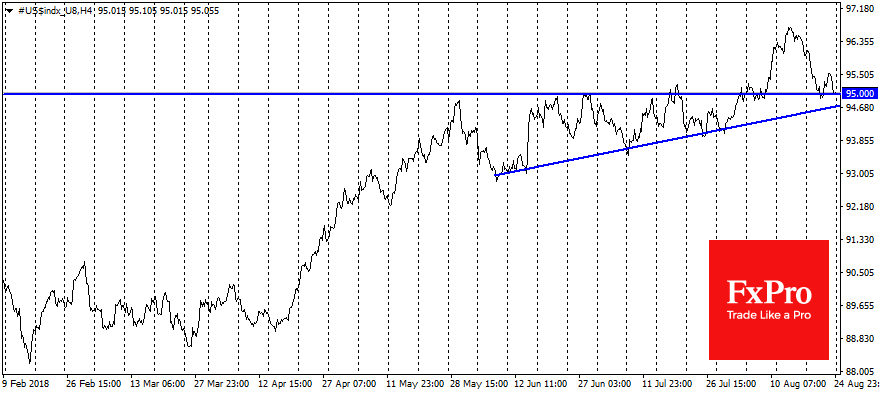

These comments have caused a somewhat reduced degree of tension around the further rate of growth, it also pushed stock markets up and added pressure to the dollar.

The dollar index returned to area 95 on Friday night, and remains at these levels at the start of trades on Monday. Last week this mark served as an important level of support. It is likely that the dollar will continue to benefit from the demand for rollback to these levels.

The EUR/USD pair grew to 1.1650 at one point at the start of the Monday, to 3 weeks highs, but lately it somewhat corrected to the area 1.1630, to the levels of Friday’s closing. Sterling is trading near 1.2850, adding 0.4% to Friday’s lows.

The development of bull market rub in the US stock markets helps to restore the demand for commodities. Gold added1.9% on Friday, returning to levels near $1205, which is quite quick recovery from lows at 1173 on August 15.

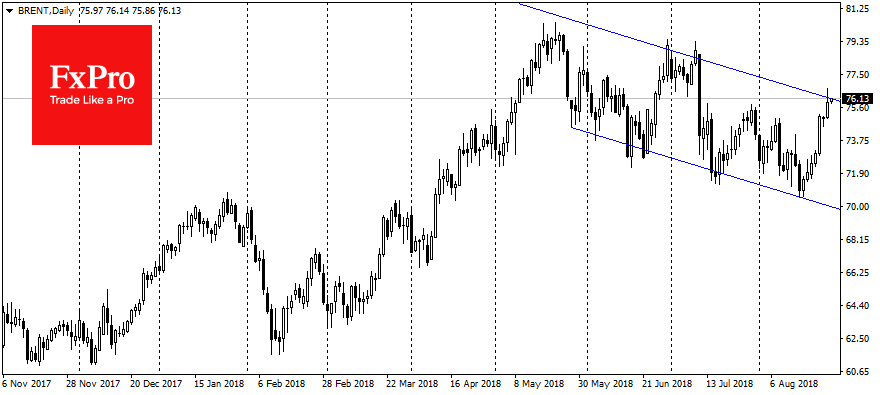

Brent Crude Oil is trading around $76 per barrel, at 7 weeks after EIA report that U.S. oil refineries are working at the limit of their capacity that would force to increase import of fuel at further growth of demand. Oil is traded at the top of the downward channel, and further growth can signal an over of downward trend, which is in effect from the end of May.

Alexander Kuptsikevich, the FxPro analyst

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI