Bitcoin price today: hovers around $118k ahead of US crypto bill vote

Home builders are feeling the most confident they have in years. Sure the Fed says that interest rates are going to start rising soon, but they will be rising off of historic lows. The double digit interest rate mortgages of the past are not likely to come back. Or at least not for many years.

And the cost of home building inputs has been falling. Timber is off nearly 40 percent from the 2013 peak and copper more than 40% from its highs. Finally, there has been ample labor force to put to work building homes as the millennials start to have families and move to the ‘burbs.

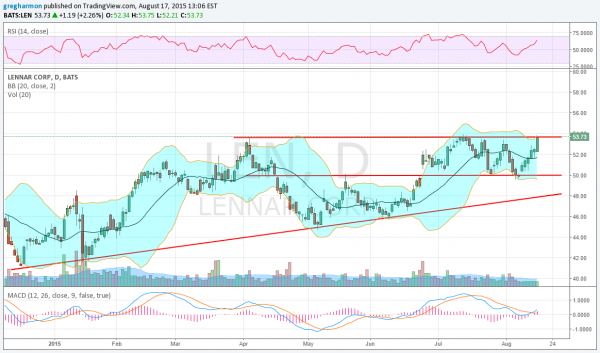

One company in this space, Lennar Corporation (NYSE:LEN), has been doing quite well. And its stock price has been trending higher. The chart above shows the price action over the last 9 months. The rising trend support is shown with a series of higher lows. Since April there has been a lid on it at 53.75 and it is again approaching that level.

On a shorter basis, the stock has moved in a channel between 50 and 53.75 since mid June. The 50 level shows significance as prior resistance over the April-to-June timeframe. Resistance has now become support as often happens.

With the move to resistance this time, the Bollinger Bands® are opening to allow more upside. The momentum indicators are bullish, too, with the RSI moving higher in the bullish zone and the MACD crossing up. A break out to the upside will have support. And it has over 13% short interest that could fuel a short squeeze as shorts cover when the stock moves higher.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI