Bernstein looks at what Trump’s policy bill means for consumers and retailers

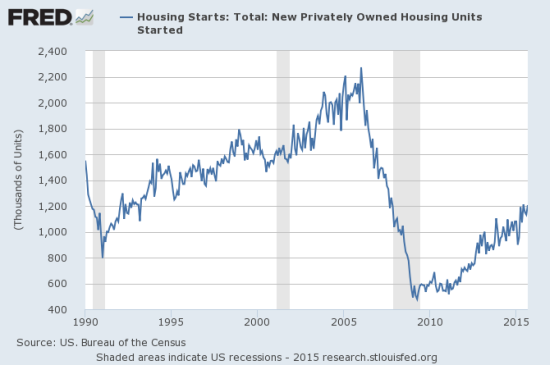

Sentiment among homebuilders has been riding high. This month, the sentiment of homebuilders reached heights last seen during the bubble days. Builders have backed up this optimism with housing starts at post-recession highs. While these starts are STILL at levels considered recessionary in previous housing cycles, the trend continues to march upward and bullishly. There is plenty of potential upside ahead.

At an annualized rate of 1.2M, housing starts are STILL hanging around levels previously considered recessionary.

For September, 2015 the Census Bureau reported 1,206,000 total annualized housing starts, a very healthy 17.5% year-over-year gain. Single-family starts came in at 740,000 units, also a healthy 12.0% year-over-year gain.

The West and the South led the way with 19.0% and 16.3% year-over-year gains respectively. The Midwest retreated 6.0% and the Northeast gained 3.7%. Based on October’s Housing Market Index (HMI or homebuilder sentiment), I am looking to the Northeast to make the most relative gains in the coming months.

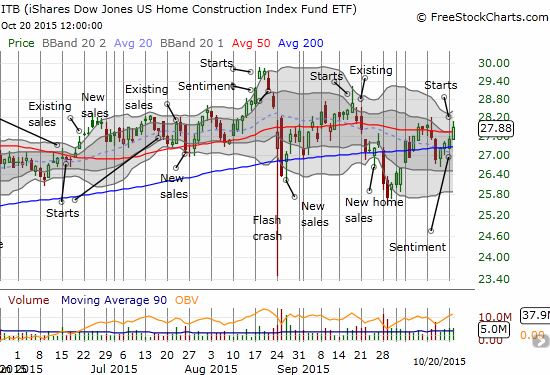

The iShares US Home Construction ETF (N:ITB) followed up the news with a 1.3% gain on the day yesterday and a fresh break above its 50-day moving average (DMA).

The iShares US Home Construction ETF (ITB) is on the upswing again but will the 50 and 200DMA pivots hold ITB close?

From a technical standpoint, ITB is looking better and better. Buying on the dips remains particularly attractive.

Be careful out there!

Full disclosure: long ITB call options

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI