Morgan Stanley identifies next wave of AI-linked "alpha"

Judge Judy’s Opinions On Valuations And The Buffet Indicator

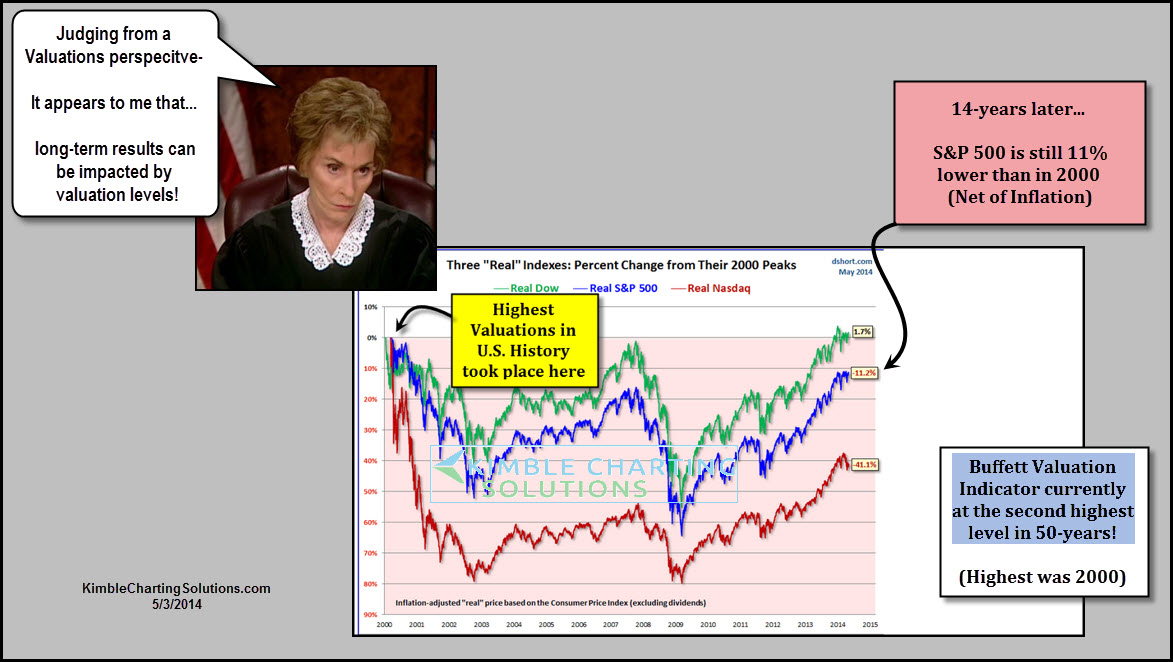

This chart reflects that the S&P 500 is down 11% (net of inflation) since valuations hit record levels back in 2000. The Nasdaq 100% remains down 44% (net of inflation) during the same time frame.

So, speaking of valuations, where do they stand today,compared to 2000?

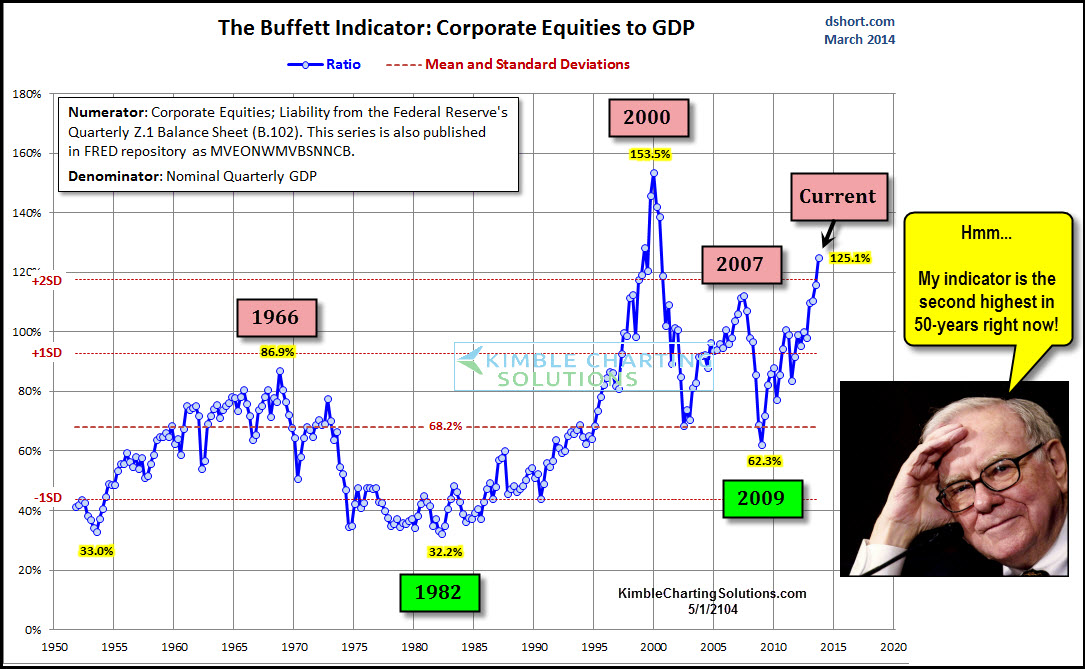

The Buffett Indicator reflects that valuations are well below 2000 levels. If you take out the 2000 levels, the current reading of this indicator does reflect it is currently at levels not seen in the past 50-year, even above 2007.

Can the stock market move higher with valuation levels at current readings? For sure it can!!!

When it comes to long-term portfolio construction I do wonder this. Have many long lasting bull markets, that make money net of inflation, have started when the Buffett indicator was at current levels?

In judgement, The Buffett indicator is anything but the holy grail for portfolio construction! It can serve though as a great perspective tool on valuations and their long-term impact to performance.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI