I’m starting to see more things that suggest the worst isn’t behind us. The churn during March and April didn’t show big signs of fear or mass selling. Some of the measures of breadth I highlighted this week like NYAD didn’t turn down with the market for example…and has now turned down.

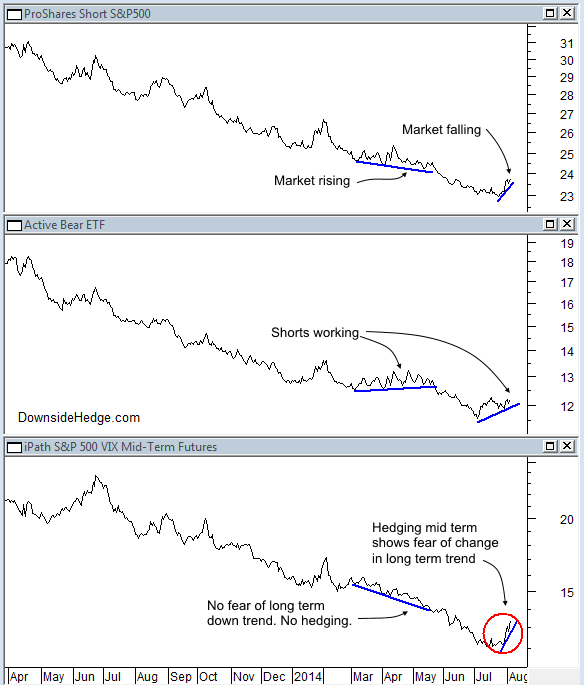

Another way to look at the strength of the market, fear, and amount of selling is by comparing various “short” ETFs. During March the only ETF that was affected by the churn was the actively managed bear fund (HDGE). It moved slightly up, as the market moved sideways to up and mid term volatility fell. The falling volatility showed that market participants weren’t afraid of a longer term market top, but saw the market action as rotation.

Fast forward to today and we see a different picture. The market is falling (SH rising), shorts are working (Active Bear – HDGE) is rising, and people are pushing mid term volatility up (S&P 500 VIX Mid-Term Futures ETN (NYSE:VXZ)). This shows broader based selling and more fear. It provides warning that this decline could continue as more people pile on.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.