U.S. consumer prices rise by 2.7% in June

Spread Narrows -- Driven By U.S. Crude Transport Fundamentals

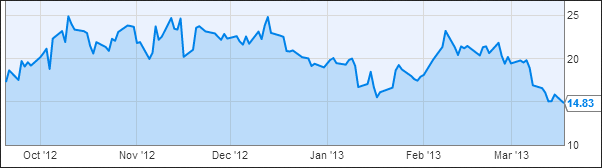

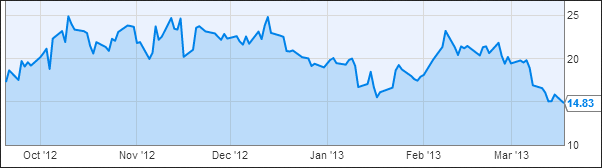

Brent-WTI spread touched a low not seen since July of last year. North American crude has moved closer to being priced by the international oil markets.

Source: Ycharts

WSJ: The price gap between the world's two most-important oil contracts shrunk to the narrowest in nearly eight months Tuesday, as new transportation links helped U.S. oil futures extend gains versus Europe's Brent crude.

Increasing pipeline capacity and rising rail shipments in recent months have helped shrink an oil-supply glut in the middle of the U.S. that has weighed on domestic oil prices.

After start-up issues in January, the newly expanded Seaway Pipeline is set to increase oil shipments to the Gulf Coast later this year. Rail transport of oil also has more than doubled over the past year, according to industry statistics, moving crude to refineries along the coast that didn't have access to domestic crude output.

And last week, operators of the Longhorn pipeline reversed its flow to send oil from west Texas to refineries along the Gulf Coast, further relieving the glut.

The new transport links, part of a broader transformation of the U.S. from energy consumer to major energy producer, are showing signs of overcoming a two-year struggle to move oil from new fields in North Dakota, Texas and other regions to the refiners pumping out gasoline and other fuels.

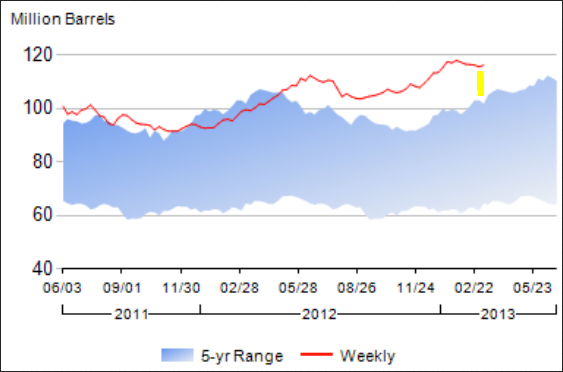

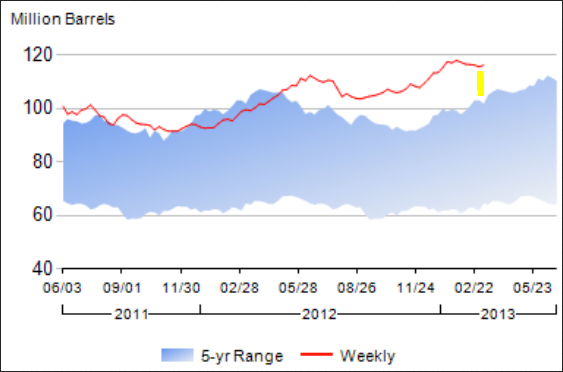

Crude supplies in Cushing, OK -- the deliverable on the WTI futures contract -- are still elevated, but have stabilized relative to historical trends.

It will take considerable amount of time for the "convergence" between these two markets -- the infrastructure is still not fully there. There is also always going to be a basis between Rotterdam and the U.S. Gulf delivery points. But we are seeing signs that the days of outsize spreads between the two benchmarks may be coming to an end.

Brent-WTI spread touched a low not seen since July of last year. North American crude has moved closer to being priced by the international oil markets.

Source: Ycharts

WSJ: The price gap between the world's two most-important oil contracts shrunk to the narrowest in nearly eight months Tuesday, as new transportation links helped U.S. oil futures extend gains versus Europe's Brent crude.

Increasing pipeline capacity and rising rail shipments in recent months have helped shrink an oil-supply glut in the middle of the U.S. that has weighed on domestic oil prices.

After start-up issues in January, the newly expanded Seaway Pipeline is set to increase oil shipments to the Gulf Coast later this year. Rail transport of oil also has more than doubled over the past year, according to industry statistics, moving crude to refineries along the coast that didn't have access to domestic crude output.

And last week, operators of the Longhorn pipeline reversed its flow to send oil from west Texas to refineries along the Gulf Coast, further relieving the glut.

The new transport links, part of a broader transformation of the U.S. from energy consumer to major energy producer, are showing signs of overcoming a two-year struggle to move oil from new fields in North Dakota, Texas and other regions to the refiners pumping out gasoline and other fuels.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Crude supplies in Cushing, OK -- the deliverable on the WTI futures contract -- are still elevated, but have stabilized relative to historical trends.

It will take considerable amount of time for the "convergence" between these two markets -- the infrastructure is still not fully there. There is also always going to be a basis between Rotterdam and the U.S. Gulf delivery points. But we are seeing signs that the days of outsize spreads between the two benchmarks may be coming to an end.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI