Analyst flags 9 bargain stocks in a ‘Black Friday’-style dip

Historically West Texas Intermediate Crude (WTI - NYMEX Crude) has traded at a couple dollar premium to Brent Crude (North Sea - ICE). The fundamental reason for the WTI premium was it's lower sulfur content which makes it easier to refine. Makes sense.

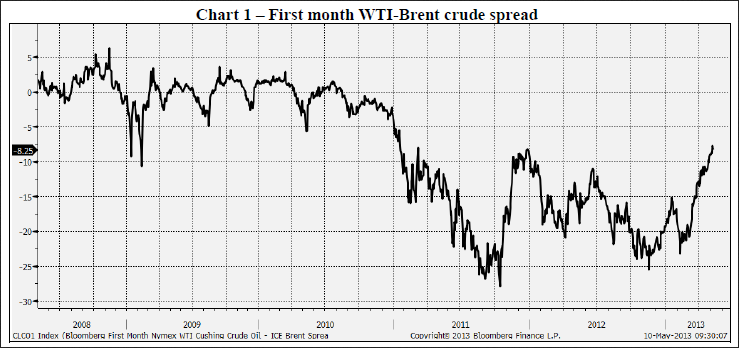

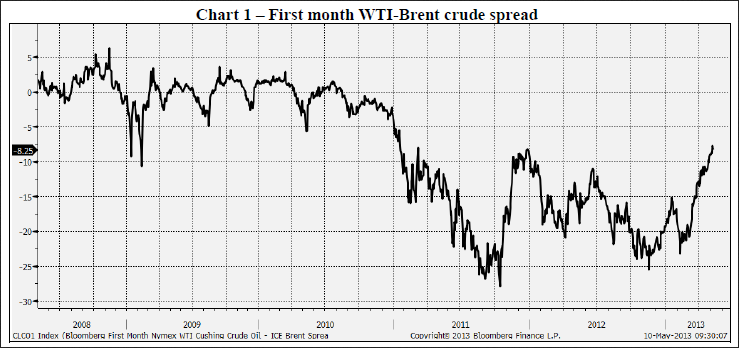

The above chart is dated (a month old) but gives you some perspective on the spread -- going back to early 2008.

At the equity market bottom in early 2009, Brent traded to a $10 premium to WTI, but the spread quickly rebounded. For the next two years (2009 - 2010) the relationship remained fairly range bound between $4 over on WTI to $5 over on Brent.

Things changed (rapidly) in early 2011 with the unrest in the Middle East/North Africa (MENA) which was dubbed The Arab Spring. Over the course of the following months, the spread moved from Brent at $5 premium to $27 wide.

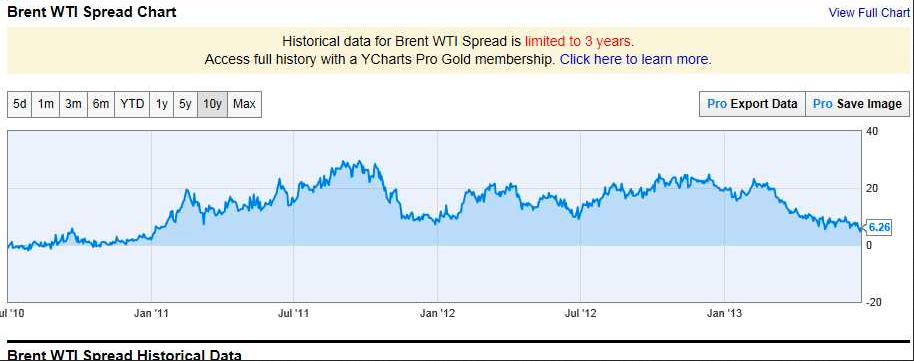

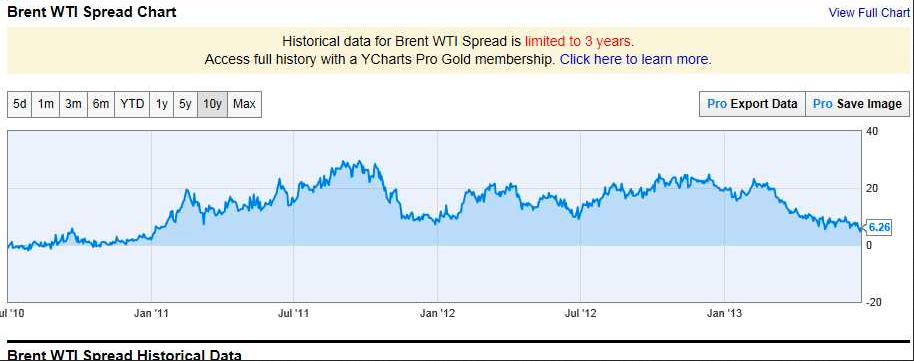

Earlier, the spread moved back through $5 wide for the first time since early 2011. I find that interesting/ironic given the percolating discontent in Egypt. While Egypt is not a meaningful Energy producer, the Suez Canal matter for ALL global trade. Obviously the Straits of Hormuz get more attention for Crude Oil followers, but you would be remiss to focus exclusively on Iran/Israel in this case.

This is a less dated chart going back 2.5 years. Notice the move starting in early 2011 and the full retrace now.

Keep in mind how much domestic/Canadian production has increased over the past five years. The considerable imbalance/dislocation in the physical market is beginning to be resolved as Crude oil stored in Cushing Oklahoma is being moved by rail to refining facilities. Furthermore, the Seaway pipeline was reversed and capacity added which brings WTI out of storage and toward Gulf area refiners. That's meaningful.

From a TRADING standpoint, I would consider getting LONG Brent v. SHORT WTI in the $5 area with stops in keeping with your risk tolerance. You could also consider options expressions out in time, but that brings in a different layer of risk (term structure, different expirations, etc).

From a FUNDAMENTAL standpoint, WTI belongs at a PREMIUM to Brent, so don't get myopic. That said, instability in the Middle East tends to put a greater bid in Brent than WTI. From a timing standpoint, consider the European close (10:30 AM Chicago time) or the US Pit session close (1:30 PM Chicago time) for trade entry.

The above chart is dated (a month old) but gives you some perspective on the spread -- going back to early 2008.

At the equity market bottom in early 2009, Brent traded to a $10 premium to WTI, but the spread quickly rebounded. For the next two years (2009 - 2010) the relationship remained fairly range bound between $4 over on WTI to $5 over on Brent.

Things changed (rapidly) in early 2011 with the unrest in the Middle East/North Africa (MENA) which was dubbed The Arab Spring. Over the course of the following months, the spread moved from Brent at $5 premium to $27 wide.

Earlier, the spread moved back through $5 wide for the first time since early 2011. I find that interesting/ironic given the percolating discontent in Egypt. While Egypt is not a meaningful Energy producer, the Suez Canal matter for ALL global trade. Obviously the Straits of Hormuz get more attention for Crude Oil followers, but you would be remiss to focus exclusively on Iran/Israel in this case.

This is a less dated chart going back 2.5 years. Notice the move starting in early 2011 and the full retrace now.

Keep in mind how much domestic/Canadian production has increased over the past five years. The considerable imbalance/dislocation in the physical market is beginning to be resolved as Crude oil stored in Cushing Oklahoma is being moved by rail to refining facilities. Furthermore, the Seaway pipeline was reversed and capacity added which brings WTI out of storage and toward Gulf area refiners. That's meaningful.

From a TRADING standpoint, I would consider getting LONG Brent v. SHORT WTI in the $5 area with stops in keeping with your risk tolerance. You could also consider options expressions out in time, but that brings in a different layer of risk (term structure, different expirations, etc).

From a FUNDAMENTAL standpoint, WTI belongs at a PREMIUM to Brent, so don't get myopic. That said, instability in the Middle East tends to put a greater bid in Brent than WTI. From a timing standpoint, consider the European close (10:30 AM Chicago time) or the US Pit session close (1:30 PM Chicago time) for trade entry.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 2 out of 3 global portfolios are beating their benchmark indexes, with 88% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?