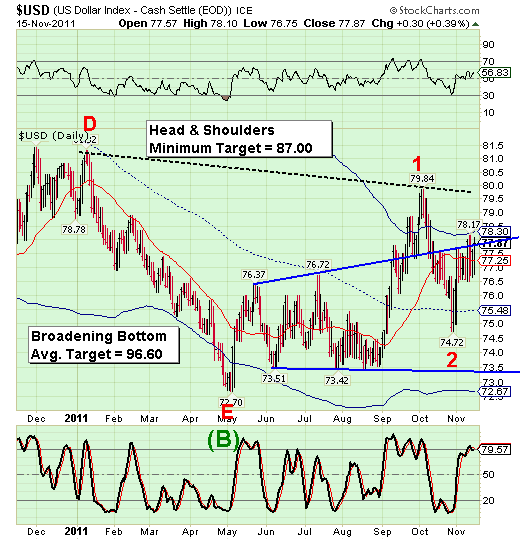

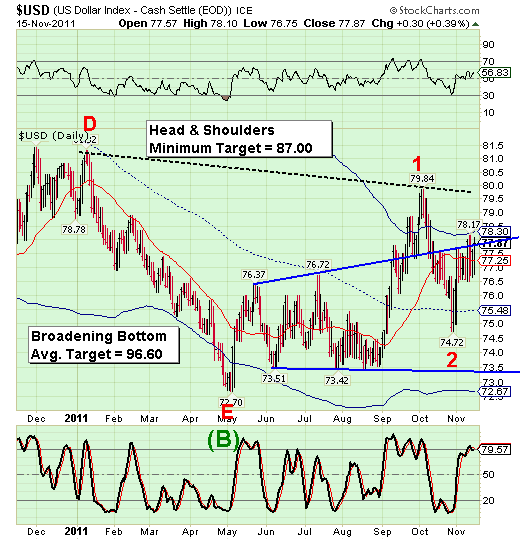

Yesterday I reported the breakdown of the Euro. This morning, the US Dollar is staging a breakout, having reached an overnight high of 78.60 in the futures. It appears to be finding support at or above its cycle top support/resistance at 78.30, which is a sign of strength. This is typical of an Elliott third wave, which appears to be beginning. This rally may continue through early-to-mid-December and it may be possible to see a cycle inversion (high instead of low) between Christmas and New Year’s day. My cycles studies suggest another probable inversion on its Primary Cycle window, which is January 21 through February 5, 2012. This corresponds nicely with the first Trading Cycle low expected at the same time.

The morning SPX futures have fallen to 1238.50 in early trading. Currently they are hovering near yesterday’s daytime low at 1244.00. It appears that the market is being bought at the support levels, but all indications are that support cannot hold much longer.

The morning SPX futures have fallen to 1238.50 in early trading. Currently they are hovering near yesterday’s daytime low at 1244.00. It appears that the market is being bought at the support levels, but all indications are that support cannot hold much longer.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.