Ether price near $4,861 record high amid flurry of corporate buying

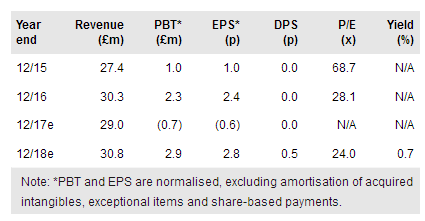

Brady (LON:BRDY)’s H1 results reveal the initial impact of the group’s transformation. While revenues slipped, reflecting the planned shift to software rental, recurring revenue rose to 68% of total revenues, up from 60% a year earlier. The move into microservices is gaining traction, with three proof of concept trials taking place in H2. Four new licences were sold in H1, all on a rental format, of which three are hosted. With nearly four months remaining in FY17, the group has 93% of revenue in the bag, including several software renewals and services business. Given the attractive long-term growth opportunities in the E/CTRM space, we believe the shares look attractive on 14x our maintained cash-adjusted FY19 EPS.

Interim results: 4 new contracts – all rental, 3 hosted

H1 group revenue dipped by 11% to £13.2m, while EBITDA before exceptional items (Brady definition) swung to a £0.9m loss from a £2.0m profit. Services fees fell 26%, reflecting the lower number of deals and timing of new deals. There was £0.6m in exceptional restructuring costs and cash slipped by £1.4m over H1 to £5.0m. Management says that FY17 results are expected to be in line with expectations, and we note that a stronger than normal H2 weighting is expected, partly due to c £2m of software licence renewals. These renewals are a legacy of the group’s historical term licence business model. Management’s focus now is on completing the strategic plan and company re-organisation, accelerating the move of the group’s business model to recurring fees and catching up on the technical and delivery backlog.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.