Bitcoin price today: slips to $117k from record peak; US inflation awaited

In a series of recent articles (here, here and here) I wrote about seasonality in the bond market. In this piece we will look at a “practical application”.

The Caveats

*Everything that I write here should be considered “food for thought” and NOT “an immediate call to action.”*Trading a leveraged fund has inherent risks that an investor should carefully consider BEFORE entering a position.The Strategy

This strategy uses funds available at Profunds, as follows:

*FYAIX (Access Flex High Yield) – High yield bonds

*GVPIX (U.S. Government Plus – 20+ year treasuries leveraged 1.25 to 1)

*MPIXX – Government Money Market fund

The Baseline

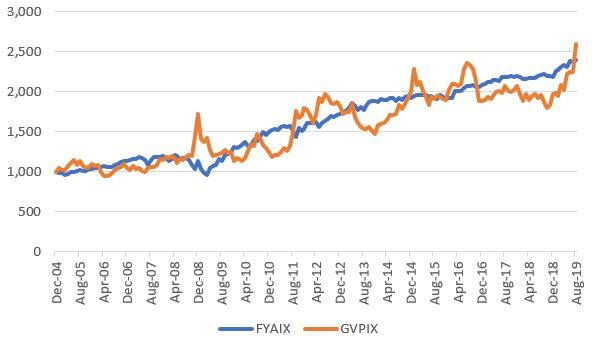

Figure 1 – Growth of $1,000 invested in High Yield Bonds (FYAIX; blue) and Long-Term Treasuries (GVPIX – orange); 12/31/2004-8/31/2019*$1,000 in FYAIX grew to $2,398*$1,000 in GVPIX grew to $2,600Jay’s Profunds Bond Calendar

Now let’s use the following calendar

Results

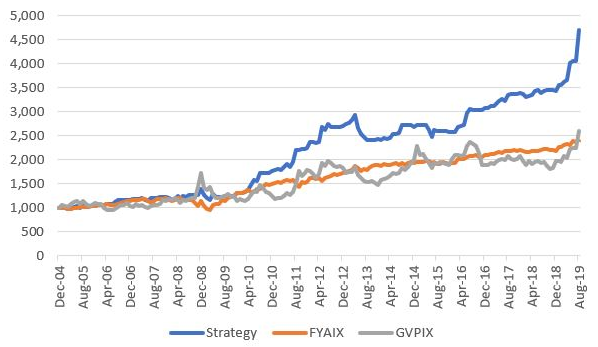

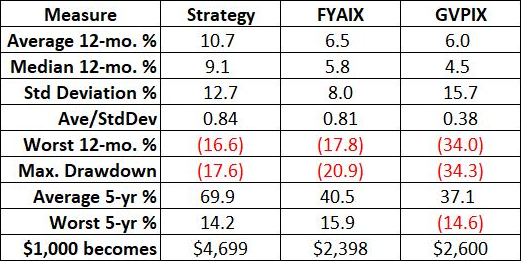

Using Jay's calendar (blue) Vs. Buy And HoldJay’s Profunds Bond Calendar System versus buy-and-holdKey things to note is that the Calendar System:*Generated significantly more return*Had a lower drawdown*Generated more consistent returnsSummary

Is this anyway to trade the bond market?

Well it’s one way.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI