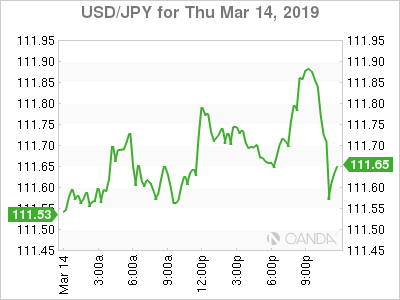

Tonight’s Bank of Japan (BOJ) rate decision is expected see no policy changes and a downgrade of their assessment of the economy. The Japanese yen has declined on growing expectations that the Bank will become more dovish; current expectations for tonight’s decision is a 44.4% that the BOJ will cut rates by 10 basis points.

The BOJ can’t ignore the terrible data prints on core machine orders, trade and inflation. The global economy remains fragile, especially after markets may have been overly optimistic that a trade deal was going to be reached between China and U.S.

If the BOJ significantly downgrades their outlook that would signal fresh measures will be coming soon. The question would be will they stick to going more deeply negative with rates, adjust their QQE yield control, or increase their asset purchases. Fresh stimulus could continue to weigh on the Japanese yen, but the risk aversion risks could keep safe-haven assets like the yen strong. The BOJ may try to hold off on doing anything and wait and see if see global growth concerns ease over the next couple months.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.