The MPC decided to leave the interest rate unchanged at 0.5% keeping its asset purchasing program unchanged at £435b as expected.

The British pound rose across the broad as The decision to keep the interest rate at 0.5% came this time with smaller majority, as The MPC member and BOE chief economist Andy Haldane has joined both of Saunders and McCafferty in preferring raising the interest rate by 0.25%.

The MPC language in its economic assessment was also much more hawkish than was predicted referring clearly to economic evolving expecting the inflation in UK to pick up in the short term by slightly more than expected.

The MPC members see now that that Q1 GDP slowdown is temporary and it is expected to grow by 0.4%, as the household spending has bounced back up strongly with continued improving of the labor market.

The committee has indicated in the same time that the wages inflation pressure remain barely positive and UK GDP yearly expansion is still standing well below 3% yearly.

The MPC sees that it will be appropriate to move in the path of tightening by a gradual and limited way showing that the reduction of BOE's QE asset holdings will be by a gradual and predictable pace.

The committee members voting and language pave the way for bank rate hiking by the end of this year driving GBP/USD to stand now well above 1.32, after it failed to do so on the back of Theresa May winning of voting on key Brexit laws in the House of Commons.

However the Greenback is still expected to remain strong, after The Federal Reserve referred to the possibility of tightening by another 0.50% by the end of this year on continued improving the labor market amid rising of the inflation pressure and increasing of the economic activity.

XAU/USD is still heading to the downside trading near 1260$ per ounce under the pressure of the interest rate outlook in US, Despite the demand for safe haven on the trade tensions between US from a side and China, EU and Canada from other sides.

After Trump raised this week the markets worries about facing series of retaliates can dampen the global recovery by his announced moving toward imposing more tariffs on Chinese goods of up to $200B.

The market focusing remain on OPEC members conflicts in Vienna, as Saudi Arabia is set for raising the production limit. Saudi Arabia’s Oil Minister Al-Falih said today that increasing the Oil output by 1 million bpd is a good target to work with, as the Short-term oil demand growth is big while Saudi Arabia is having 2 bpd spare capacity currently.

Trump asked for that increasing, after he had withdrawn US from the Iranian nuclear deal placing back the US sanctions on it threatening its trading counterparts fulfilling demands from Middle East countries, despite the opposing of European countries have found more benefits on building business relationships with Iran.

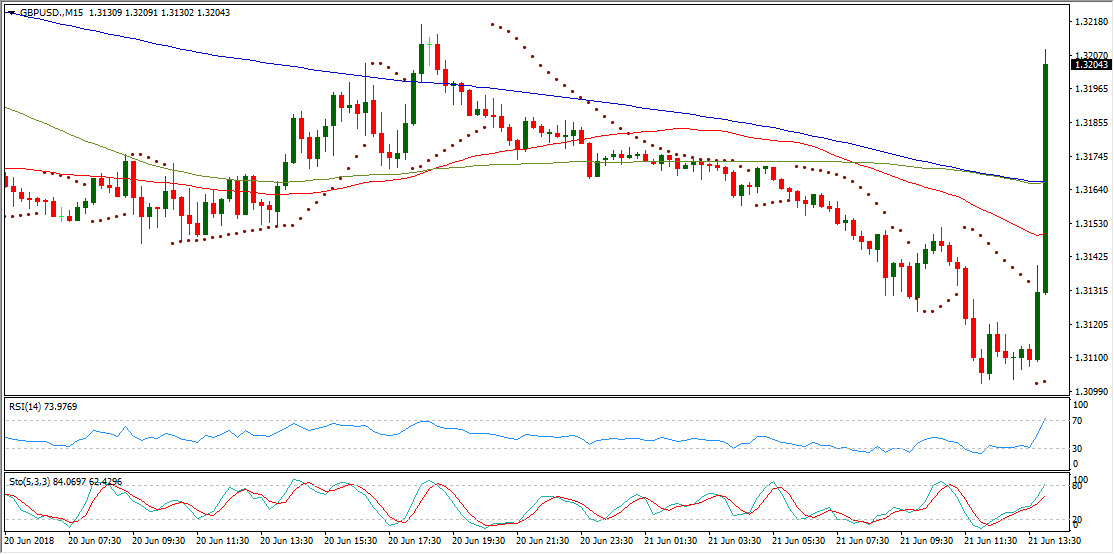

GBP/USD 15m Chart:

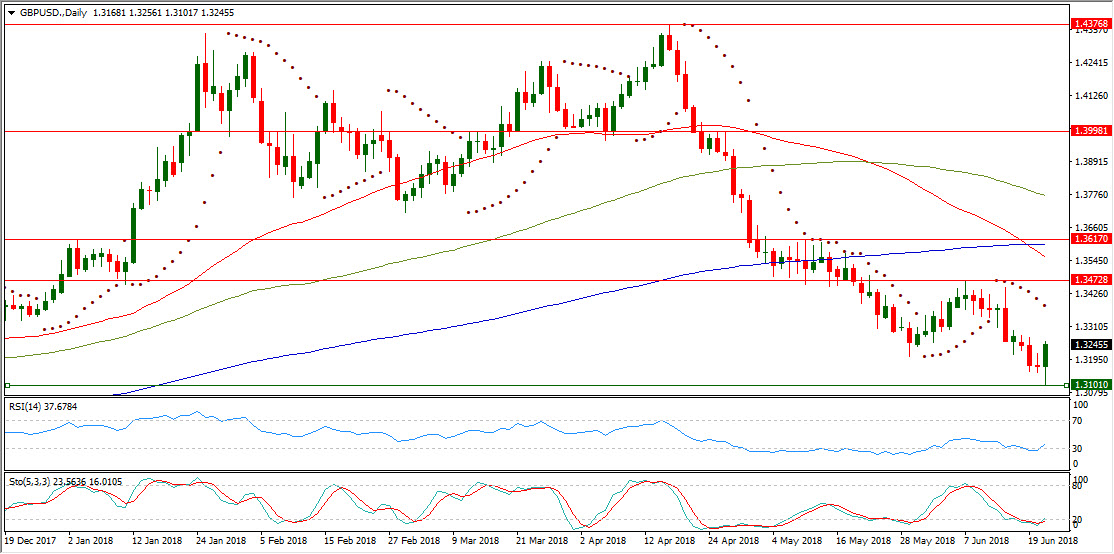

GBP/USD Daily Chart:

After GBP/USD resumed its slide today to 1.3101 it could bounce up for trading currently close to 1.3250 containing most of this week slide in strong reversing sign to the upside over the short term.

However the pair is still well below its daily SMA50, its daily SMA100 and its daily SMA200 to continue to be exposed it to forming lower high.

GBP/USD is trading in its seventh consecutive day of being below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 1.3383.

GBP/USD daily RSI-14 is now referring to existence inside the neutral area coming up from its oversold region below 30 reading 37.678.

GBP/USD daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line inside the neutral area at 23.563 leading to the upside its signal line which is still in the oversold area below 20 reading 16.010, after positive crossover inside it.

Important levels: Daily SMA50 at 1.3554, Daily SMA100 at 1.3771 and Daily SMA200 at 1.3599

Experienced S&R:

S1: 1.3101

S2: 1.3026

S3: 1.2775

R1: 1.3472

R2: 1.3617

R3: 1.3998