The Bank of England will be in the spotlight on Thursday as it announces its latest monetary policy decision, releases the minutes from its meeting including voting details, releases its inflation report and Governor Mark Carney and colleagues conduct a press conference. Investors will be hoping to get some much needed clarity on the position of the BoE given how cloudy its expectations have become since the last meeting.

Predicting when the BoE will raise interest rates has become an impossible task and its Carney’s job today to send a clear message to the markets. As it stands, the consensus appears to be for late next year, which I think is far too late. If the markets are currently pricing this in then we could see quite a sharp reaction in the pound if Carney does follow the Federal Reserve in suggesting that a rate hike is just around the corner.

While focus in the U.K. this morning may be on the BoE, there will also be a lot of attention on the U.S. and the Fed again as we get unit labour cost data that could hold the key to future price inflation. The Fed has made it very clear that it will assess both realized and expected progress towards its targets when it meets in December, a statement clearly made on the basis that current inflationary pressures barely exist. This means that measures of future inflation become increasingly important and one of those is unit labour costs.

The second quarter saw unit labour costs fall by 1.4% as productivity increased much more than the 1.8% increase in compensation. While this isn’t ideal, the fact that the decline in costs is due to high levels of productivity and not poor wage growth is important. Moreover, across the last four quarters, unit labour costs rose by 1.7% which is consistent with inflation heading back towards the Fed’s target. While higher unit labour costs would be better and this would then be passed on to the consumer and lift inflation, if the numbers can remain in line with the last four quarters, I think it will be good enough for the Fed. Of course, this will just be one of many measures the Fed looks to for signs of future price inflation.

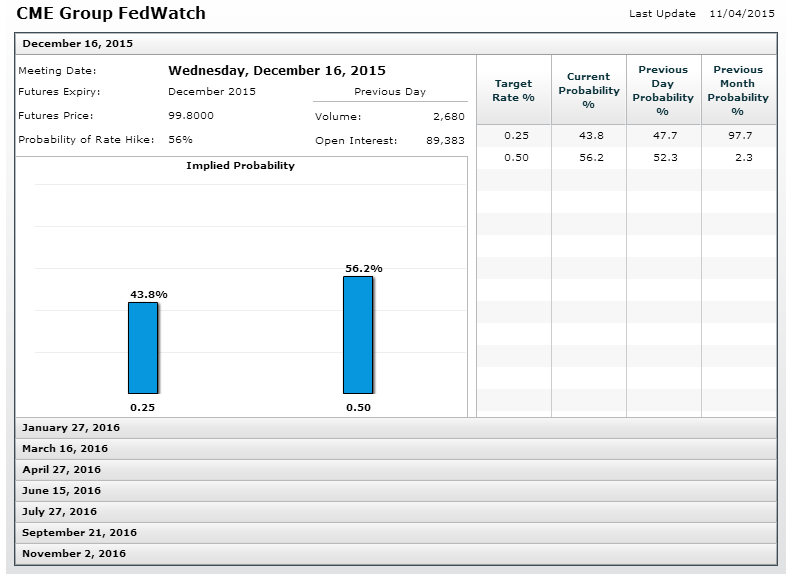

Also of note today will be Fed speeches with a large number of officials due to appear including Vice Chair Stanley Fischer and William Dudley. The Fed has largely stuck to message since last month’s meeting, with economic data continuing to be the key to a December hike. It would appear that unless we see a serious deterioration in the data, the Fed plans to hike. Therefore, barring a change in rhetoric from Fed officials, this will continue to be more priced in. As it stands, Fed Funds futures suggest the odds of a rate hike stand at around 56%.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.