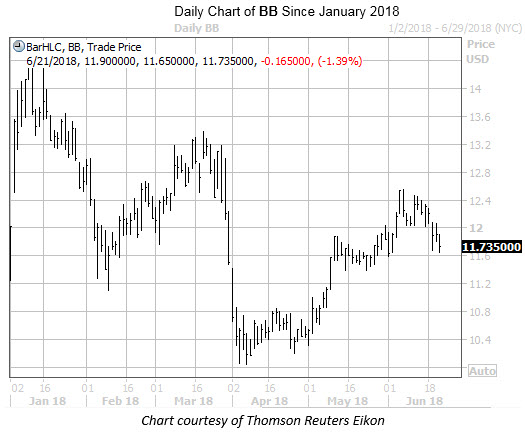

BlackBerry Ltd (NYSE:BB) is slated to report first-quarter earnings before the open tomorrow. BlackBerry stock is down 1.4% at $11.74 at last check, set for a third straight close below the 20-day moving average. The shares have struggled to gain momentum since their roughly five-year high from January, clinging to a slim year-to-date lead. Still, options activity has been bullish in recent weeks.

Looking back at recent earnings release, BB will try to duplicate the post-earnings success it found back in December, when the shares jumped 12% in the subsequent session. In March, however, the equity dipped 1.6% the day after earnings. This time around, the options market is pricing in a large 11% swing for Friday's trading, per implied volatility data.

Meanwhile, BlackBerry's call open interest is sitting near the bottom percentile of its annual range. Still, call buying has been the popular strategy recently, with data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) showing BB with a 10-day call/put volume ratio of 11.25, ranking in the 74th percentile of its annual range. In other words, calls have been purchased over puts at a faster-than-usual clip.

During the most recent two-week time frame, the weekly 6/29 12-strike call saw the largest increase in open interest. Data points to almost exclusive buy-to-open activity here, showing traders are expecting a breakout above $12 in the next week or so.

On the flip side, analyst attention has not been so optimistic towards BlackBerry stock. All six brokerage firms following the stock sport "hold" or "sell" ratings. Further, BB's average 12-month price target of $11.73 sits in line with current trading levels.