Bitcoin is gradually losing ground. Now the benchmark cryptocurrency is hanging around $3,500 but it is increasingly sophisticated to stay there.

On Friday morning, the benchmark cryptocurrency is trading at around $3,300, weakening support around this level could result in a new sale. And in this case, there is a high probability that the BTC will continue to decline up to the next area of consolidation of July-August last year at $2,500- $2,700. The crypto camp is divided into those who are waiting the start of the bull cycle from that moment and those who think that this is not the bottom.

Indeed, if we focus on the cycles of corrections and growth, after the last drop by 85% and reaching the bottom by $180 per BTC in January 2015, in less than 2 years Bitcoin soared almost 11,000%. In the current cycle, the bottom will almost certainly be above $180, that's why crypto enthusiasts conclude that subsequent growth will surprise the entire planet again. Nevertheless, 2 years is a very long period.

The main task for investors is not to define the lowest entry point, they need to "catch" the start of the rally. And in this context, the history of Bitcoin allows us to say that it may take a very long time before the market starts to warm up again.

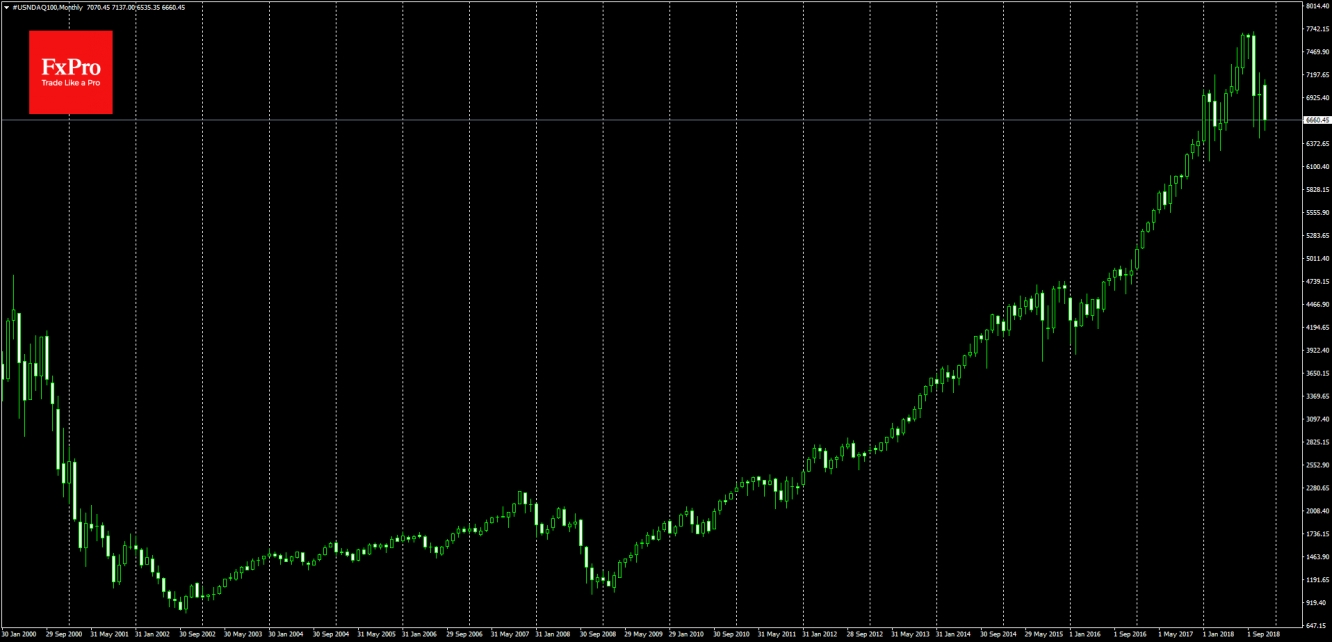

If you compare cryptocurrencies with the dot-com bubble, then it may take more than 10-15 years before the promising technologies, in which investors initially believed, to became successful projects, which largely determine the mood in the markets. The Nasdaq index took 16 years to exceed the peak levels of 2000.

If you look at the situation not so globally, closer to the beginning of the holiday season you can expect increase in sales pressure. A year earlier, the desire to “went to Fiat” for the holiday season was a turning point. It is quite possible that approaching the end of the year will force investors to shake up their portfolios, having reduced unprofitable positions by the end of the year.

After a year-long crypto hangover, cryptocurrencies may show cautious purchases among long-term investors. However, a similar period of a jerk at the end of the year and the subsequent correction, very similar to what we saw in 2017, was in 2013. In 2014, the market experienced a long decline, as it was in 2018. Then the lows were reached in January 2015, and for investors a good entry point was a drawdown in August 2015, after which the market finally turned to growth.

Alexander Kuptsikevich, the FxPro analyst