If you have invested in cryptocurrencies such as Bitcoin, Ethereum, Ripple and many others, you probably know already that blockchain technology is the biggest thing in the market right now. The decentralized nature of the blockchain that powers Bitcoin and Ethereum makes cryptocurrency a perfect replacement for fiat currencies. Bitcoin is free from the control, interference, and manipulation of governments and its agents.

Bitcoin's use a digital currency makes it a viable investment for early-adopters who are brave enough to invest now and survive the rollercoaster ride before Bitcoin gains mass-market adoption. For what it's worth, Bitcoin is currently trading above $4000 a piece now. Bitcoin is already up more than 250% this year and Ethereum is up almost 3,500% in the year-to-date period.

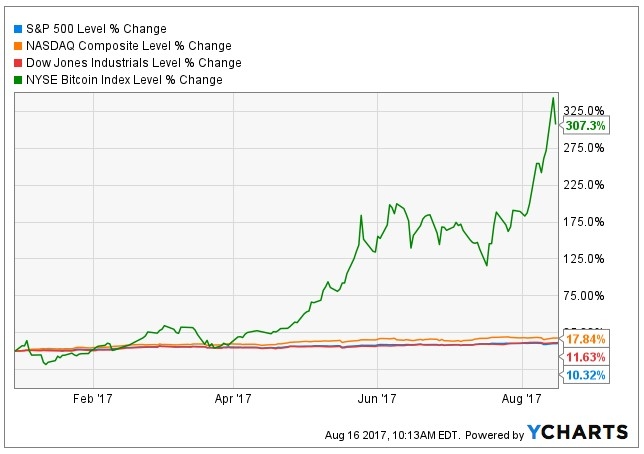

In contrast, the S&P 500 has only managed to score YTD gains of 10.32%, the Dow is up 11.63%, and NASDAQ is up 17% but the NYSE Bitcoin index is up 307.3% in the same period as seen in the chart below.

However, the unique value proposition that makes Bitcoin a great investment is also the biggest challenge delaying its mass adoption. Bitcoin is a digital currency in the real sense of the word and its use is restricted to the digital space. The fact that it is purely digital means it lacks physical features for use in the "real world". Of course, the world is gradually shifting towards a cashless economy; yet, a large number of transactions still happen in the physical space and Bitcoin will continue to lag behind fiat currencies if it remains as a purely digital currency.

Don't give up on Bitcoin just yet

Bitcoin is still being bought as an asset but its true value will be realized when it takes it rightful place as a means of exchange. Bitcoin has the potential for mass adoption, which could in turn reward investors in the cryptocurrency market with massive ROI.

Some blockchain-based startups such as CryptoPay are creating tools to bring the digital nature of Bitcoin to everyday use with a debit card that can be used anywhere Visa debit cards are accepted. Founded in 2013, Cryptopay has created a niche offering Bitcoin wallets, Bitcoin debit cards, and other payment processing solutions. With CryptoPay's Bitcoin wallet, users can conduct Bitcoin transactions, buy, store, and send Bitcoin anywhere in the world.

Bitcoin is still in infancy but the cryptocurrency is garnering a great deal of attention in the financial, investment and economic landscapes. All that Bitcoin needs is a bridge between its early adoption phase and its mass adoption phase fiat. Bitcoin will eventually take its place as a currency, but for now, we wait and continue riding the wave of Bitcoin as an asset.

Bitcoin's digital-only barrier is an hurdle

Bitcoin should have already displaced fiat currencies because it makes better economic sense and fiat; yet, Bitcoin is still struggling in its transactional use. Bitcoin is mostly being bought as an asset than as a currency. In fact, many of the U.S. companies that initially hung out a Bitcoin accepted here sign have started winding down there Bitcoin payment programs.

One of the reasons merchants are finding it hard to embrace Bitcoin is that the cryptocurrency is being plagued by low transaction volumes. A market report by JPMorgan (NYSE:JPM) revealed that only 3 out of 500 internet sellers accept Bitcoin down from 5 last year.

Interestingly, the main reason merchants aren’t accepting Bitcoin is that not many people are interested in buying stuff with the cryptocurrency. Bitcoin's price has soared above the $4,000 mark and most of the people who own Bitcoin are choosing to hold the cryptocurrency instead of spending it. Merchants don't have much of a reason to invest in solutions that will make it easy for them to accept Bitcoin payments.