In the crypto world, we are seeing momentum coming back for Bitcoin. There is no doubt that sentiment is strong among investors and traders who firmly believe, but now institutions also, I have no other choice but to join the party. This is despite the fact that we had some serious warnings from the upcoming head of the SEC, Gary Gensler.

The fact is that there is a strong need to eradicate all the sham projects from the crypto arena. Bitcoin certainly does not belong to that equation. Yes, it is a very volatile asset, but so are many other stocks these days that have adopted the same sort of volatility that we experienced previously for Bitcoin. If Goldman Sachs (NYSE:GS) launches its trading desk for cryptos, it will be the most significant news since Tesla (NASDAQ:TSLA).

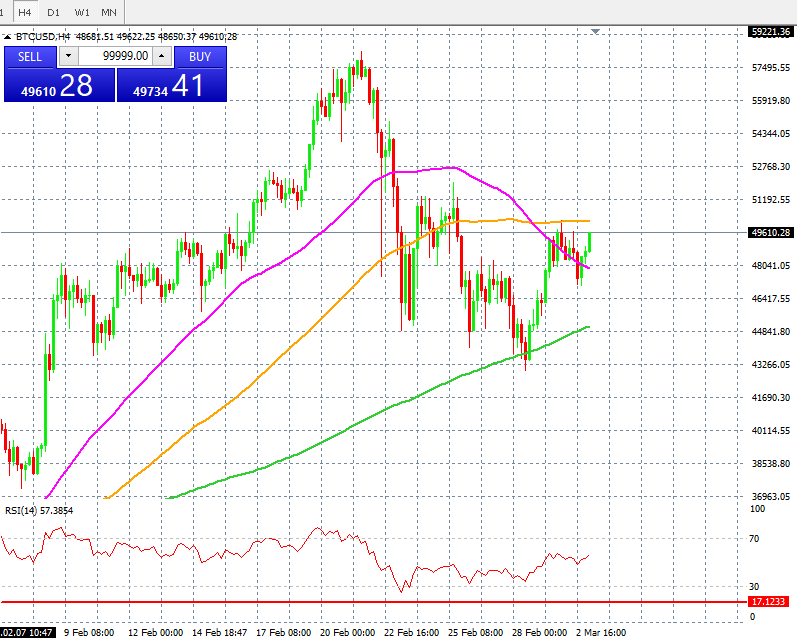

In terms of technical analysis, Bitcoin price has crossed above the 50-day simple moving average on the four-hour timeframe, and the only challenge it is likely to face is the 100-day simple moving average. The near-term resistance is at 50,299, and the moment the price crosses above this particular price level, we are likely to see Bitcoin price marching towards the all-time high. From there, it will be a journey towards the 70,000 price level.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.