These could be the 5 biggest pain trades in the second half, HSBC says

The total cryptomarket capitalization is once again below $200 bln threshold as of Tuesday morning, and at the time of writing is about $196 bln. A new market drawdown was provoked by the news that the U.S. Securities and Exchange Commission (SEC) had suspended trading notes (ETN) on BTC until September 20, citing that investors can confuse ETN and ETF.

Although the bitcoin (BTC) managed to regain its position, the overall market is showing confusion: the top 10 cryptocurrencies are stuck between growth and decline.

Winklevoss Brothers’ Crypto exchange launches its version of the dollar-pegged token, GUSD. The company wants to push out the share of Tether (USDT), whose reputation has recently suffered due to suspicions of market participants’ manipulation with the BTC price, as well as the insecurity of the fiat dollars account. It is widely known that Winklevoss twins owned about 1% of all existing bitcoins, and this does not remove the main claim: Gemini may also be suspected of manipulation through GUSD.

Nevertheless, the current level of capitalization is about $200 billion, it is still significantly above the values of $17-30 bln. in early 2017, which points to the formation of a basic layer of long-term crypto-investors who do not sell cryptocurrency on the lows. How strong their margin of safety is will become clear as new lows will be achieved in the medium term.

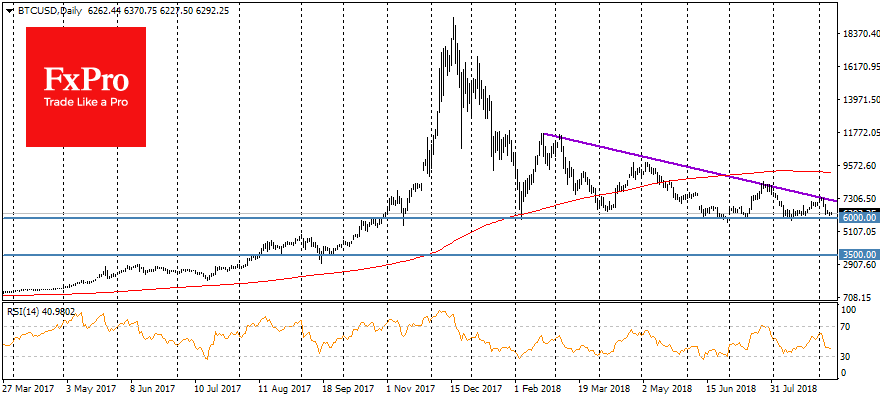

The graphical analysis suggests that despite the stabilization, the significant support for the bitcoin is 5% lower than the current levels, i.e. near $6000 against current $6300. In general, the Bitcoin remains within the downward triangle, the borders that have become dangerously close. The formation of this figure will formally be completed with a failure under the level of support at 6000 (most possible scenario), which would open the way to the collapse up to $3500. However, for the growth-prone financial assets (as stocks) often are common the spreads to growth. We can talk about this scenario only if we overcome the previous peaks of the course at $7300.

Alexander Kuptsikevich, the FxPro analyst

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.