BofA warns Fed risks policy mistake with early rate cuts

In our past analyses, we continuously pointed to the support line's importance at $52567 for Bitcoin. Last week, we fell below that mark, and the bears set a clear signal with it that they are still to be reckoned with. We adjusted our alternative scenario's probability by increasing it to 48%. However, the movement was not enough to transform the alternative scenario into the primary scenario. The reason for that is that the bears reached an optimal target for the corrective movement. In addition, the indicators give some room to lessen the tension here.

Accordingly, the bulls have a final chance to regain the control over the sinking submarine called Bitcoin. As things stand right now, we believe that the Bitcoin course built another [i],[ii]-setup in violet, after already a 1,2-setup in green – this would mean that we are facing a very bullish trend going forward. This is our primary expectation, but only has a chance of 52%. For the bulls to truly come through, we need new all-time highs soon!

Everything less than that would not speak in favor of the bullish structure that we have just outlined above. Whether the bulls manage to make such a push is still linked to a big question mark. Since the primary and secondary scenario probabilities are pretty close together, we are currently not trading in this market. If you are more willing to take risks, a stop at $46417 would be suitable for entering long positions. If the Bitcoin price falls below that mark, the bulls are out of the game for a while and prices below $32000 and further down south are going to be reached in the course of a bearish attack.

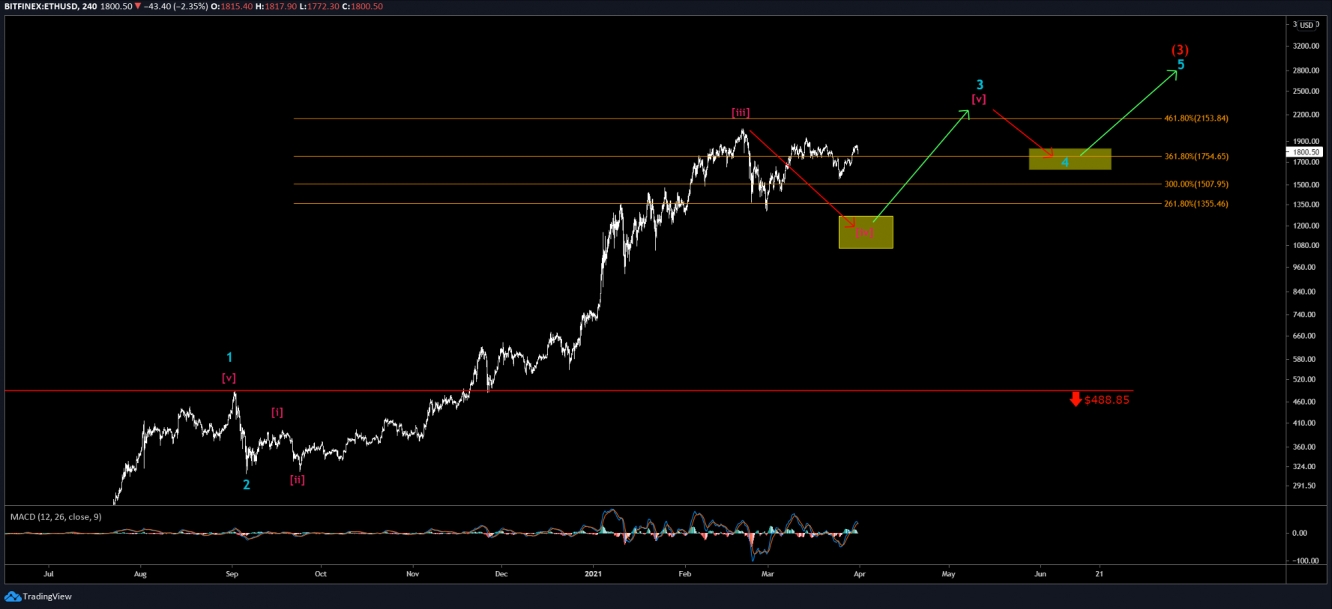

In comparison to Bitcoin, Ethereum's situation looks considerably worse. From the outset, the bulls were not able to push for another all-time high. Moreover, the indicators that display the wider time horizons are all rather pointing downward. Finally, Ethereum has completed a shoulder-head-shoulder pattern lately, which can indicate a change in the trend (ever since this pattern the price decline already). We have changed our primary expectation because of the outlined reasons, which is directed down south where we should reach a region around $1100. From there, we expect that the price turns around and continues to follow the overarching bullish pattern of this market. Already, we have outlined a trading zone, which is marked in yellow. We will use this zone to stock up long positions. As we are approaching the trading zone, we will further narrow down the coordinates to give a more accurate prediction. As an alternative course of action, however, Ethereum might follow Bitcoin's pattern of movement. In this case, the market would position itself in a bullish structure and would directly push to reach the $2000 mark and even exceed it considerably. This alternative remains probable as long as we remain above $1445; below that mark, this alternative would no longer be.

To summarize, in both cryptos, the corrections are dangerously close, and it has even become the primary scenario for Ethereum. Nonetheless, we expect both cryptocurrencies to gain much value in the future and remain invested on the long side.

Which stocks should you consider in your very next trade?

Successful investors know to check multiple angles before making their move. InvestingPro's three powerful features work together to give you that edge:

ProPicks AI runs 80+ stock-picking strategies, including Tech Titans, which doubled the S&P 500's performance in just 18 months!

Fair Value combines 17 proven valuation models to help you spot overpriced stocks and undervalued gems.

And WarrenAI delivers instant insights on any stock. Ask questions, get vetted answers backed by real-time data (unlike ChatGPT).

Our subscribers use all three to identify stocks before double-digit gains and avoid costly mistakes.

But with 50% during our Summer Sale, even if you only use one of these features the value pays for itself. Sale ends soon—don't wait until prices go back up.

Save 50% while you can