Stock market today: S&P 500 in weekly loss as trade war fears intensifyy

The Biotech sector ended a long run higher in July of 2015. From that peak, the Biotech Index lost over 40% the next 7 months. Since that February low, though, the sector has languished. It has attempted to rise a couple of times only to fail and fall back. Several things in the chart of the Biotech ETF (NASDAQ:IBB) suggest that this pattern may be coming to an end.

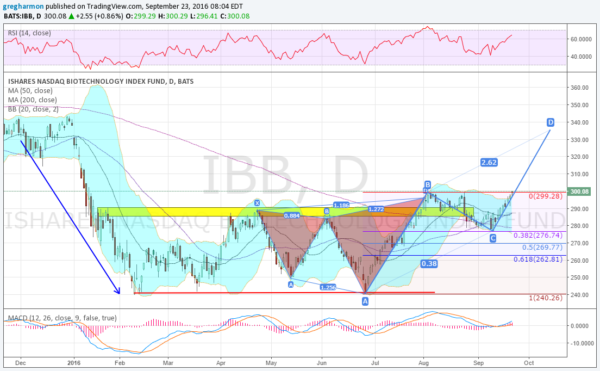

The chart below shows the last leg down and the aftermath of the fall from the highs. A broad-based consolidation from February through August led to a failed break out. But on closer review, the failure may be the start of a reversal out of consolidation and to the upside.

Since making a high in April, the price action has traced out a bearish Shark harmonic pattern. That reached its Potential Reversal Zone (PRZ) in August and prompted the pullback. Two weeks ago the Index retraced 38.2% of the pattern, reaching its target. Since then it has been all upward price action. This pullback was also a retest of the 200-day SMA, which held as support. Coming into Friday, the Biotech Index is at the August high, and has bullish momentum behind it.

A break to the upside to a new higher high would give a target on an AB=CD pattern to 335. in addition to the bullish momentum from a rising RSI and MACD, the Bollinger Bands® are opening to the upside. And the chart shows a Golden Cross, with the 50-day SMA crossing up through the 200-day SMA. Everything is lining upi for a bullish run higher in Biotechs.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.