Equities

Outstanding earnings from Apple on Tuesday evening helped propel Asian markets higher on Wednesday. The Nikkei rallied 1.1% to 8840, as a drop in the Yen boosted exporters such as Sony, which surged 4.8%. The ASX 200 climbed 1.1%, and the Kospi inched up .1%. Markets in China and Hong Kong remained closed for the Lunar New Year.

Concerns over Greek’s debt situation pressured European banks, sending the FTSE down .5% and the CAC40 down .3%. Nonetheless the DAX managed a slight gain. The European mobile sector fell after Ericsson missed profit forecasts.

US stocks advanced in the afternoon, thanks to a commitment from the Fed not to raise interest rates for at least 2 years. Tech shares led the advance, as the Nasdaq gained 1.1% to 2818. The Dow rose 83 points to 12759, and the S&P 500 closed up .9%.

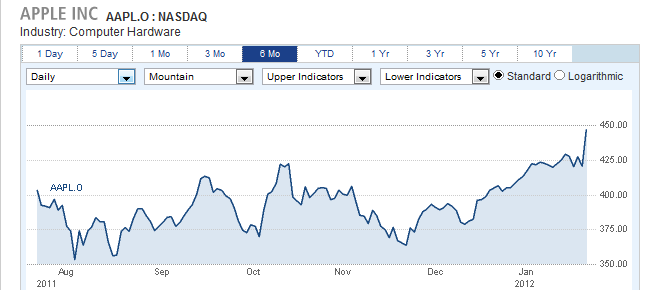

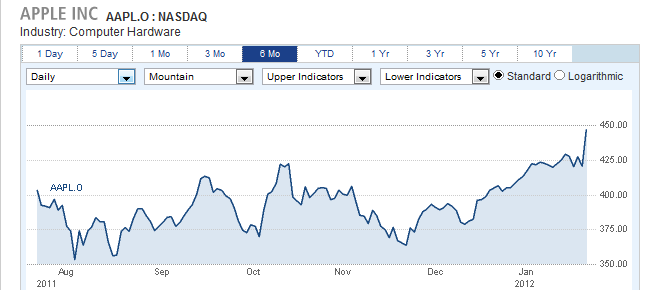

Apple shares surged 6.2% to 446.66 after reporting earnings which exceeded analyst forecasts. 15 brokerage firms raised their targets on the stock, which settled at an all time closing high.

Currencies

The Australian Dollar jumped 1.2% to 1.0606, as the US Dollar fell against its peers. The Euro and Canadian Dollar both rose .6% to 1.3115 and 1.0039 respectively, and the Pound gained .3% to 1.5670. The Yen eased fractionally to settle at 77.72, and the Swiss Franc advanced .7% to 1.0858.

Economic Outlook

Pending home sales fell 3.5% in December, following November’s 7.3% advance. On the plus side, the OFHEO home price index rose by 1%, more than expected.

Thursday’s economic calendar will include durable goods, weekly jobless claims, new home sales, and leading indicators.

Outstanding earnings from Apple on Tuesday evening helped propel Asian markets higher on Wednesday. The Nikkei rallied 1.1% to 8840, as a drop in the Yen boosted exporters such as Sony, which surged 4.8%. The ASX 200 climbed 1.1%, and the Kospi inched up .1%. Markets in China and Hong Kong remained closed for the Lunar New Year.

Concerns over Greek’s debt situation pressured European banks, sending the FTSE down .5% and the CAC40 down .3%. Nonetheless the DAX managed a slight gain. The European mobile sector fell after Ericsson missed profit forecasts.

US stocks advanced in the afternoon, thanks to a commitment from the Fed not to raise interest rates for at least 2 years. Tech shares led the advance, as the Nasdaq gained 1.1% to 2818. The Dow rose 83 points to 12759, and the S&P 500 closed up .9%.

Apple shares surged 6.2% to 446.66 after reporting earnings which exceeded analyst forecasts. 15 brokerage firms raised their targets on the stock, which settled at an all time closing high.

Currencies

The Australian Dollar jumped 1.2% to 1.0606, as the US Dollar fell against its peers. The Euro and Canadian Dollar both rose .6% to 1.3115 and 1.0039 respectively, and the Pound gained .3% to 1.5670. The Yen eased fractionally to settle at 77.72, and the Swiss Franc advanced .7% to 1.0858.

Economic Outlook

Pending home sales fell 3.5% in December, following November’s 7.3% advance. On the plus side, the OFHEO home price index rose by 1%, more than expected.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Thursday’s economic calendar will include durable goods, weekly jobless claims, new home sales, and leading indicators.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI