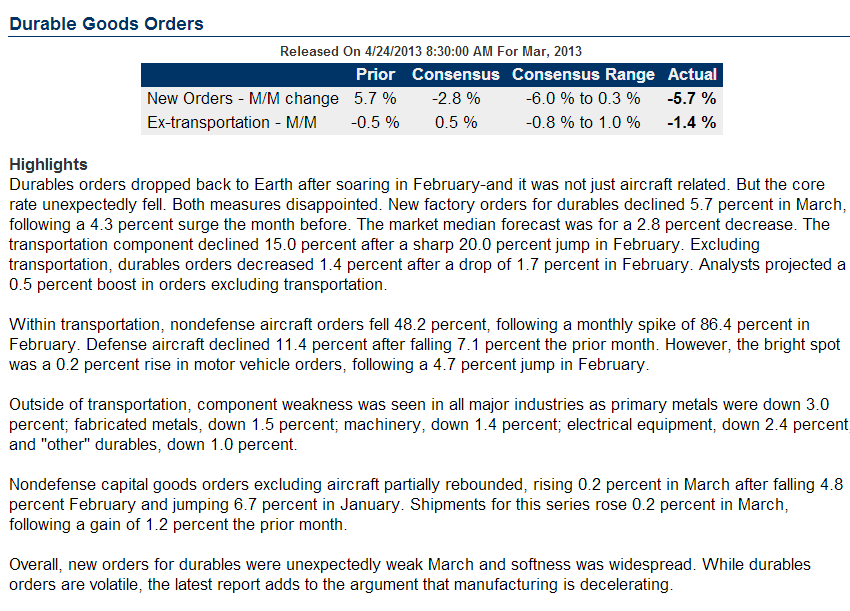

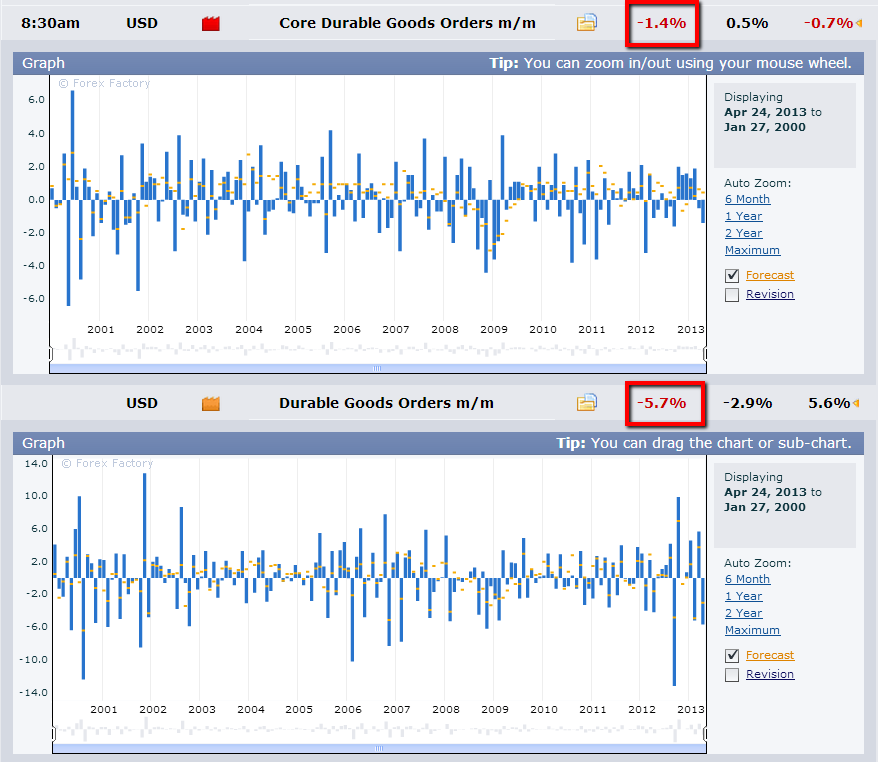

More weak data released yesterday (Wednesday) shows a big drop in Durable Goods Orders and Mortgage Purchase Applications, as shown below.

All of this weakening data this year points to a slowing economy, not an expanding one. Perhaps at some point, the markets will reflect this. Until then, they remain (in "The Twilight Zone") pushed up against 4-year highs (and all-time highs in some cases)...the result of the Fed's influence (and other Central Banks around the world, particularly Japan), and not the normal laws of market supply and demand. This reminds me of the story, "The Emperor Wears No Clothes"...at some point, the public will wake up (and admit) to reality, and Ben (and his cohorts) will be looking for a new tailor (and possibly updating their Linkedin profiles). ;-)

Data Sources: Nasdaq and ForexFactory

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI