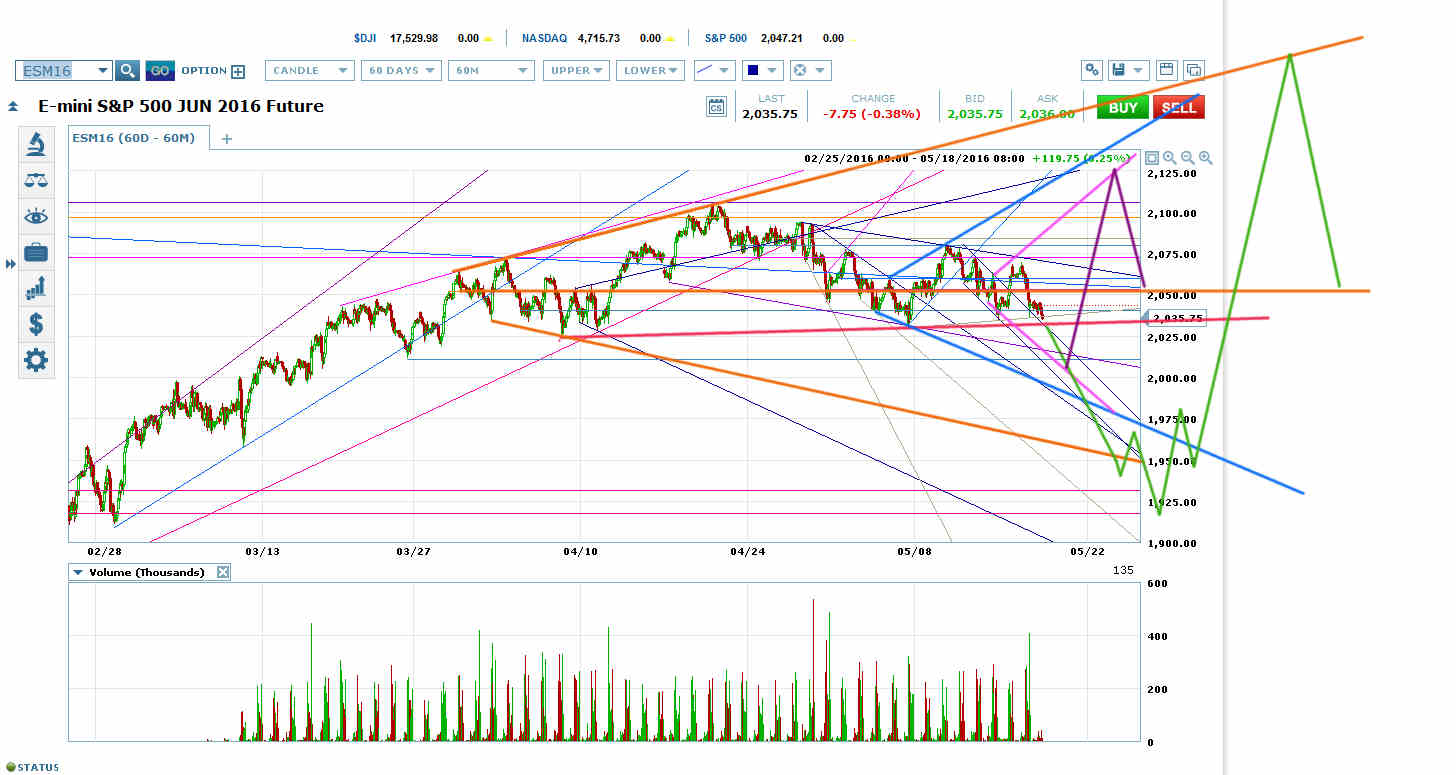

ES is Trying to Break Out of its H&S (Red Neckline) to the Orange Megaphone Bottom but Watch Out for Those Smaller Megaphones

ES is trying to break out of a head and shoulders on its 60-minute chart (red neckline). The theoretical target would usually be the bottom of the orange megaphone way down at 1950. Add a small breakout for a bottoming formation and ES would probably reach somewhere around 1925-1935.

Then ES would have a mandatory retrace to the orange megaphone VWAP at 2050 to put in. If it were to get through that level, it would be going for at least 2080 and probably the orange megaphone top.

But I’ve seldom seen a bearish set-up I hated this much. First, it’s the middle of opex week. A giant move down like this would seldom get going during opex week without some major fundamental short-term catalyst (like the market crash in China during opex last August) because options sellers, which tend to be dominated by big money, have such a strong incentive to keep that kind of sell-off from happening.

Second, today is Fed minutes day, when Yellen gets to cheer up the market.

Third, there are incomplete smaller megaphones across 2050 with bottoms at around 2000 that would usually require a retrace to VWAP before breaking out downwards, which would mean recrossing the H&S neckline at roughly 2030.

Fourth, ES headed down during opex week in response to three Fed speakers talking up a June rate hike, while actual market bets on a June rate hike barely budged. And oil is in the critical decision wave of a small price channel within a larger price channel, with no sign of breaking out into a serious inflation-causing move.

Right now, ES has formed a small megaphone across its triangle bottom at roughly 2041. If this little megaphone actually breaks out downwards, it’s most likely good for a move to 2000ish, then a retrace to 2050, and then we see.

If the little megaphone breaks out upwards, the target is at least 2080 and probably 2100+.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.