The expectations game surrounding further QE from the Federal Reserve is still alive and well following Ben Bernanke’s appearance in front of the Senate yesterday. While there was no explicit mention of another round of asset purchases, the fact that they weren’t ruled out has been enough to keep the addicts waiting for the next hit.

Price action in the US dollar was fairly whippy as a result, with the dollar stronger as he started his testimony before sloughing off as it became clear that the door had very much been left open.

UK inflation dropped substantially yesterday to 2.4%, the lowest since November 2009. The largest drop was seen in clothing prices and although this is good news it may only be a temporary factor due to the on-going poor summer. If the weather heats up, inflation is likely to follow unfortunately. Sterling was offered fairly well after the number, on fears that these falls could see an inflationary undershoot i.e. dramatically less than the Bank of England’s 2% target or that the lower inflationary environment may give the Bank of England further cause to add more QE. The minutes from the Bank’s last meeting are due at 09.30 this morning, and we will get to see just how unanimous the vote for more QE was.

Germany’s economic miracle is further falling apart with yesterday’s ZEW index coming in at the worst number for 6 months. Given the country’s reliance on exports and falling domestic confidence and demand, the slip back to recession for Germany may be already underway.

The euro has remained above 1.22 against the dollar in the past week, albeit at times by the skin of its teeth, although the gradual grind for sterling against the single currency we forecast has continued perfectly. We are unsure as to how willing market participants will be to getting freshly short of the euro at these levels, especially against the USD, so reversals on short covering cannot be ruled out.

UK unemployment will be a key release today. Unemployment data has actually been not too bad here, certainly compared with trends in other developed nations. That being said, the slowdown in growth that the global economy is going through will likely reverse in the coming months.

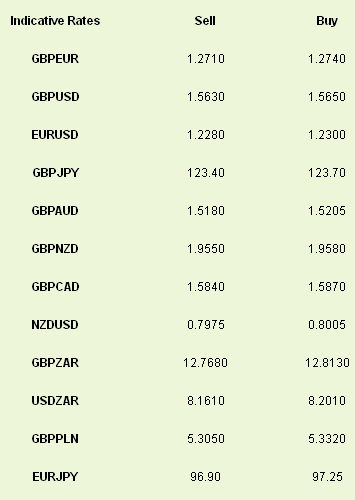

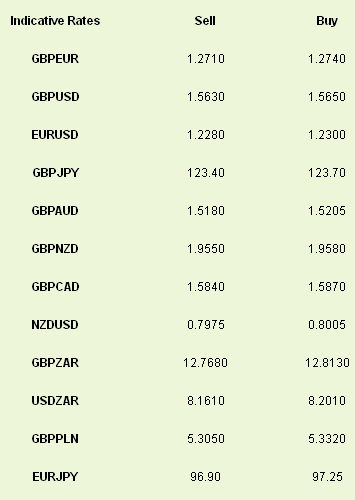

Please note these rates are “interbank” rates ie they indicate where the market is currently trading and are not indicative of the rates offered by World First. Rates are dependent on amount transacted. It is important to remember that foreign exchange rates fluctuate all the time. The rate you will receive will depend on the amount and currency you require.

Price action in the US dollar was fairly whippy as a result, with the dollar stronger as he started his testimony before sloughing off as it became clear that the door had very much been left open.

UK inflation dropped substantially yesterday to 2.4%, the lowest since November 2009. The largest drop was seen in clothing prices and although this is good news it may only be a temporary factor due to the on-going poor summer. If the weather heats up, inflation is likely to follow unfortunately. Sterling was offered fairly well after the number, on fears that these falls could see an inflationary undershoot i.e. dramatically less than the Bank of England’s 2% target or that the lower inflationary environment may give the Bank of England further cause to add more QE. The minutes from the Bank’s last meeting are due at 09.30 this morning, and we will get to see just how unanimous the vote for more QE was.

Germany’s economic miracle is further falling apart with yesterday’s ZEW index coming in at the worst number for 6 months. Given the country’s reliance on exports and falling domestic confidence and demand, the slip back to recession for Germany may be already underway.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The euro has remained above 1.22 against the dollar in the past week, albeit at times by the skin of its teeth, although the gradual grind for sterling against the single currency we forecast has continued perfectly. We are unsure as to how willing market participants will be to getting freshly short of the euro at these levels, especially against the USD, so reversals on short covering cannot be ruled out.

UK unemployment will be a key release today. Unemployment data has actually been not too bad here, certainly compared with trends in other developed nations. That being said, the slowdown in growth that the global economy is going through will likely reverse in the coming months.

Please note these rates are “interbank” rates ie they indicate where the market is currently trading and are not indicative of the rates offered by World First. Rates are dependent on amount transacted. It is important to remember that foreign exchange rates fluctuate all the time. The rate you will receive will depend on the amount and currency you require.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI