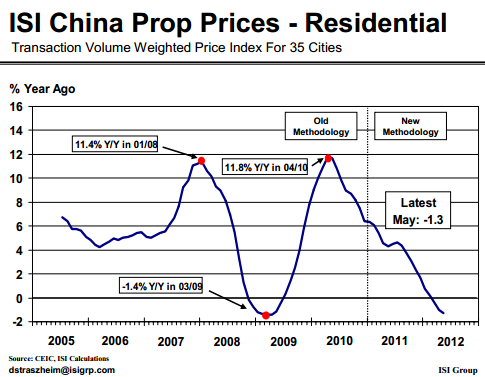

China's residential property values are continuing to decline. The chart below from ISI Research shows that the rate of decline is now similar to the lows in early 2009. And data from ISI tends to be more accurate than the official numbers coming out of China's housing ministry.

But make no mistake about it - much of this decline has been engineered by Beijing, as they attempt to arrest the housing bubble.

Reuters: An unnamed spokesman from the housing ministry was quoted as saying that "all localities must firmly implement various property tightening measures as required by the central government."

In spite of this being an "unnamed spokesman," such policy directives are fairly common. And this particular directive is not at all surprising. Beijing is sending a stern message to local authorities to keep the measures place.

However as the nation undergoes an economic slowdown, which may end up being more severe than the authorities had anticipated, the tightening measures in the housing market may be relaxed (particularly at the local level).

Reuters: ... the weakening economy, likely to grow at its slowest pace in more than three years this quarter, is fuelling expectations that Beijing will probably have to relax property curbs if external headwinds worsen.

Reinforcing such expectations are local governments' steps to make it easier for first-time home buyers, by relaxing policies marginally so as not to irritate Beijing while stimulating local housing transactions.

The local governments have profited tremendously from the housing boom and will do whatever they can to prop up sales and prices. There is some anecdotal evidence that home sales have indeed been brisk. But given the high levels of unsold inventories, any material increases in prices from this point are unlikely.

Reuters: ...high inventories will cap any quick rebound in home prices in the near-term, [China Securities Journal] cited Home Link analyst Chen Xue as saying.

Vanke, China's largest developer by sales, said earlier this month it would take about 11 months to sell down unsold stocks in key cities such as Beijing, Shanghai and Shenzhen.

"I'm not worried about a home price rebound as long as the government keeps its tightening stance," Hui Jianqiang, head of research at the China Real Estate Association, told Reuters after the data.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Beijing Engineers The Decline In Resi Property Values

Published 06/20/2012, 03:53 AM

Beijing Engineers The Decline In Resi Property Values

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.