One of the reasons that I haven't gotten short on this market in the last week with the sudden market weakness that shook traders up on Thursday is because, the sell-off didn't begin last Thursday. In individual stocks the sell-off began in the beginning of July and stocks across the board have been weakening ever since.

Take the T2108 for instance and you'll see how the percentage of stocks trading below the 40-day moving average has been rapidly declining since the beginning of July.

Take a look for yourself.

As you can see we are historically at levels where the bottom is put in and the bounce ensues. As a result, getting short at these levels offers limited reward and high levels of risk.

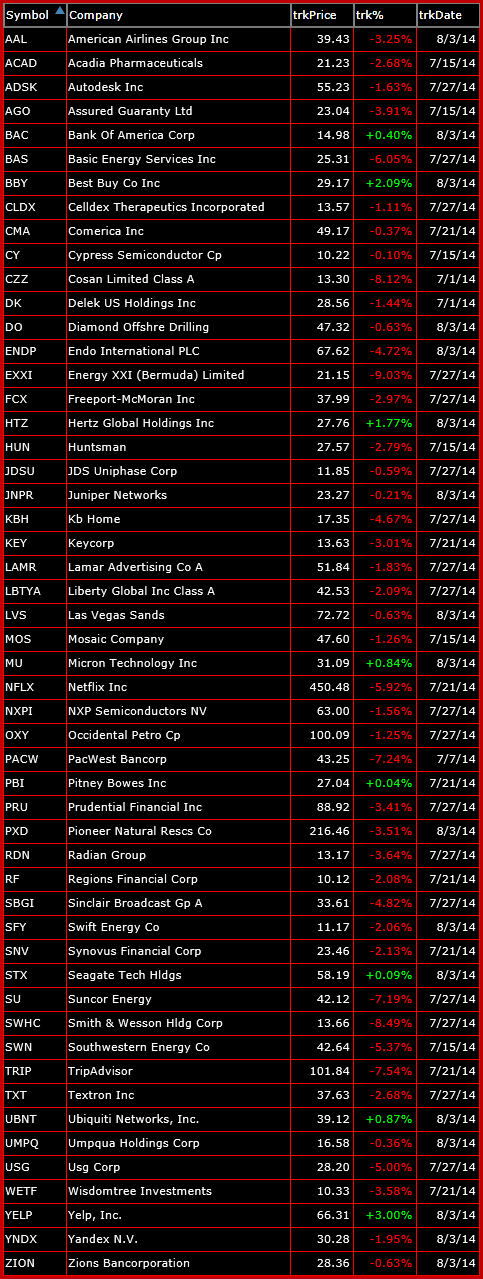

So I don't have plans at this moment to get short any of the stocks below. I need to see more of a bounce than what we saw yesterday. So for now, keep this list near by and be ready to pounce on this market with the shorts below once we finally manage to get dead cat bounce that alleviates the high levels of risk for us.

Here's the bearish trade setups:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI