Morgan Stanley identifies next wave of AI-linked "alpha"

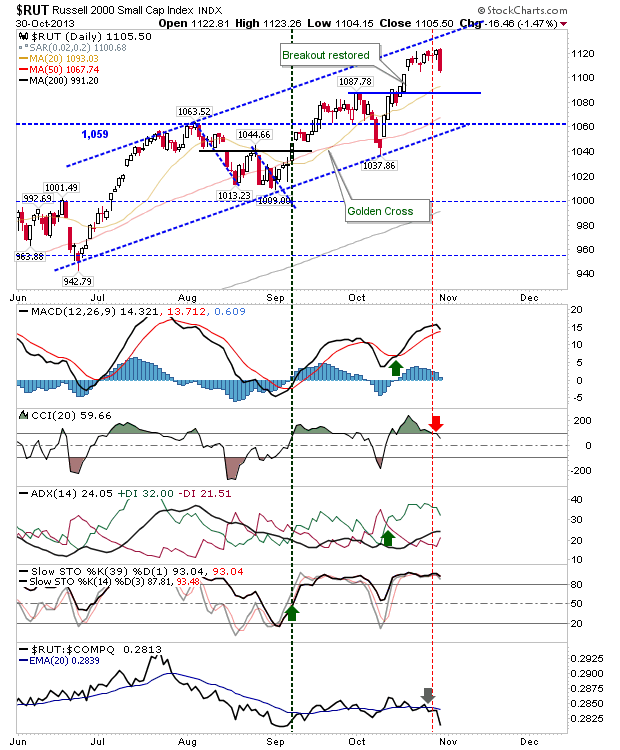

Small Caps took the biggest hit from sellers yesterday with a substantial bearish engulfing pattern (at least, relative to the last couple of weeks). The rally didn't make it to channel resistance, so it will be interesting to see how it does when it makes it back to its 20-day MA.

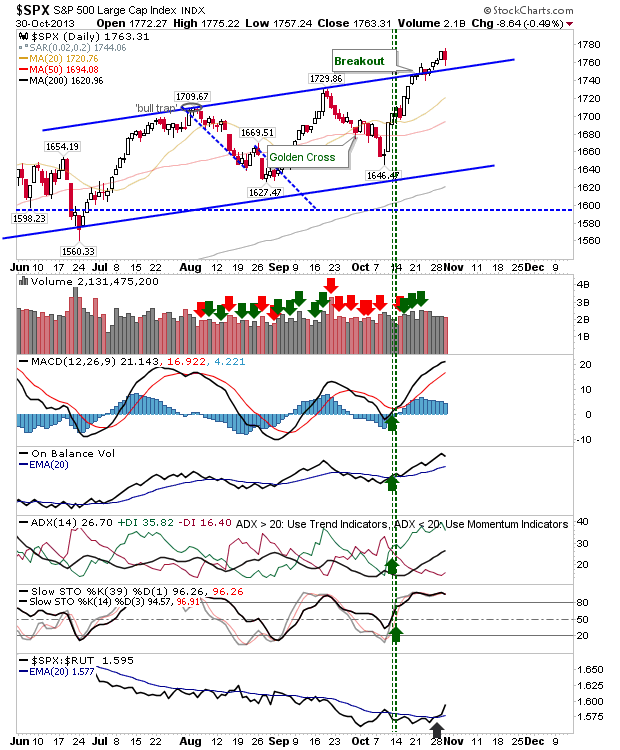

The S&P wasn't so extreme in its selling, holding above the rising channel, but we're likely to see this level tested today. Further losses will leave a shortable 'bull trap'.

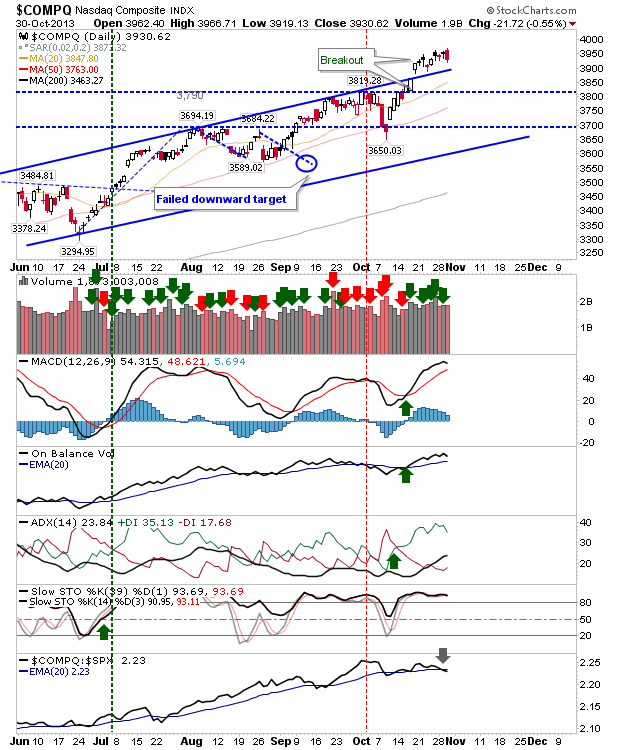

The Nasdaq had a smaller bearish engulfing pattern than the Russell 2000, but technicals remain in good shape. Relative strength momentum continued to move away from the Nasdaq to the S&P. Like the S&P, the Nasdaq has former channel resistance to lean on, in addition to 20-day and 50-day MAs. Bulls will have plenty of opportunity to buy on each of these tests.

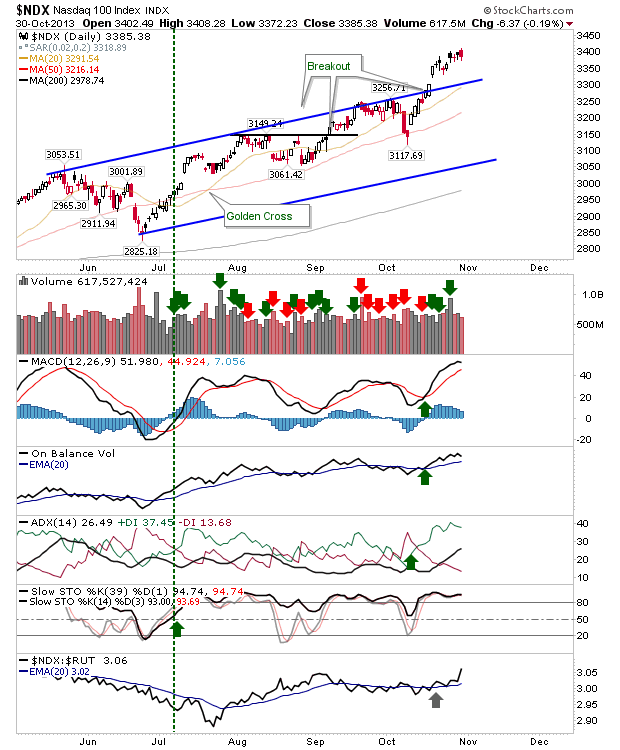

The Nasdaq 100 has seen the largest relative gain (against the Russell 2000) and has the most room to run before reaching the first level of support - likely to be the 20-day MA.

Yesterday had the look of the start of a pullback. Bulls will be looking to pick their entries: former channel resistance-turned support, 20-day MA, then 50-day MA.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI