Are banks about to get fried? They sure could if current support fails to hold.

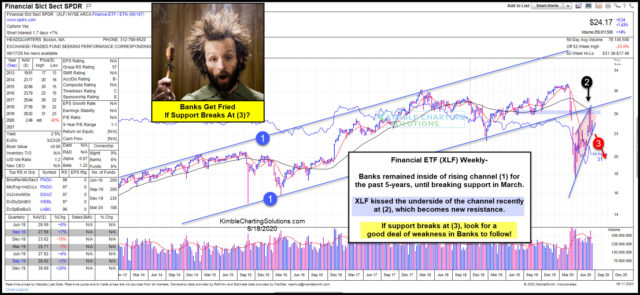

This chart looks at Financial ETF (NYSE:XLF) from Marketsmith.com on a weekly basis over the past 7-years.

XLF has remained inside of bullish rising channel (1) for the past 5-years. Weakness took it below the bottom of the channel during the February/March declines.

The rally over the past 90-days saw XLF kiss the underside of the rising channel at (2), where it created a bearish reversal pattern.

Since the March lows, XLF could be forming a bearish rising wedge, with the bottom of the wedge being tested as support this week at (3).

Could Banks get fried again? If support breaks at (3), look for underperforming banks, to outperform the broad markets on the downside.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI