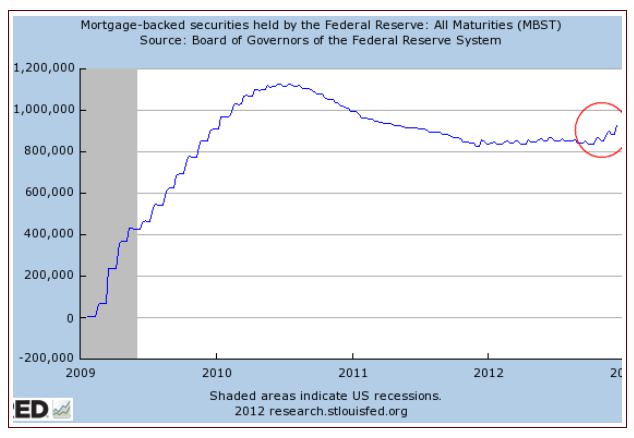

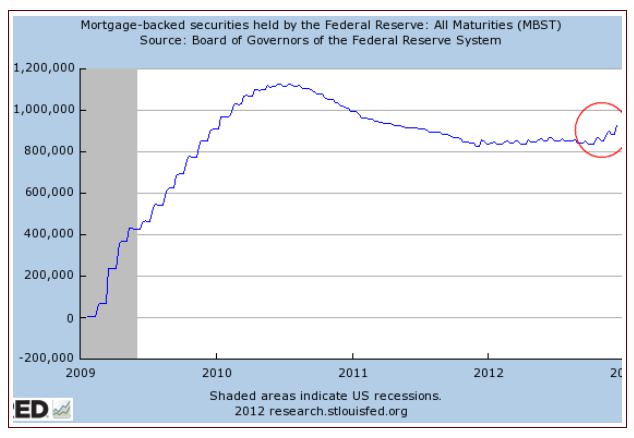

Some MBS settlements have now been reflected on the Fed's balance sheet, as agency paper holdings increase.

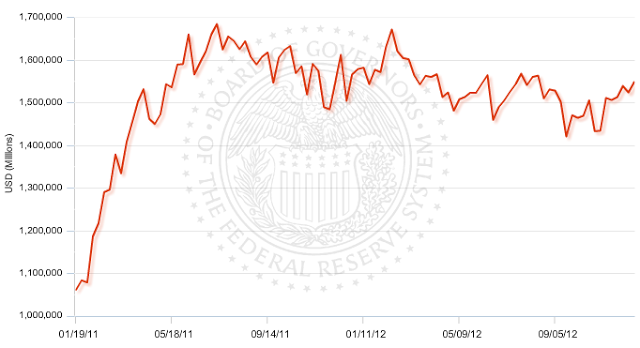

Bank reserves are also gradually moving up, though still down for the year. So far the growth in reserves has been underwhelming.

With the newly announced Treasury purchases, this should pick up steam. And the settlement schedule will be much less "lumpy" than agency MBS.

One thing worth mentioning here is that the US Treasury will be borrowing $45bn a month effectively interest free. That's because the Fed passes interest income back to the Treasury (less its own expenses) via earnings distribution once a year. This certainly helps reduce pressure on Washington to cut spending quickly - the can will be kicked down the road once more.

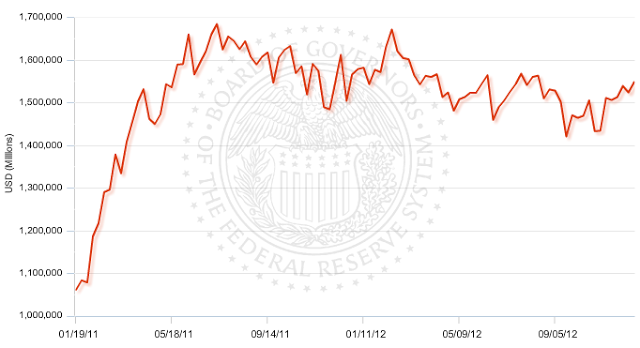

Bank reserves are also gradually moving up, though still down for the year. So far the growth in reserves has been underwhelming.

With the newly announced Treasury purchases, this should pick up steam. And the settlement schedule will be much less "lumpy" than agency MBS.

One thing worth mentioning here is that the US Treasury will be borrowing $45bn a month effectively interest free. That's because the Fed passes interest income back to the Treasury (less its own expenses) via earnings distribution once a year. This certainly helps reduce pressure on Washington to cut spending quickly - the can will be kicked down the road once more.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI