After two consecutive years of spectacular gains, which nearly tripled Bank of America’s market cap, the too-big-to-fail financial institution is having a slower, but still strong start of 2018. Bank of America Corp (NYSE:BAC) stock is up 5.22% year to date, easily outperforming the S&P 500. Besides, analysts’ estimates for the company’s future earnings are constantly improving. As of this writing, the company is expected to deliver $2.55, $2.84 and $3.47 in EPS in 2018, 2019 and 2020, respectively.

The problem is that extrapolating past performance into the future can sometimes make even the most expensive stock look cheap, since the valuation is based on profits the company has not even made yet. So, instead of relying on Bank of America’s bottom line to never stop growing, we will take a look at BAC stock’s price chart through the prism of the Elliott Wave Principle and see if it confirms the positive outlook.

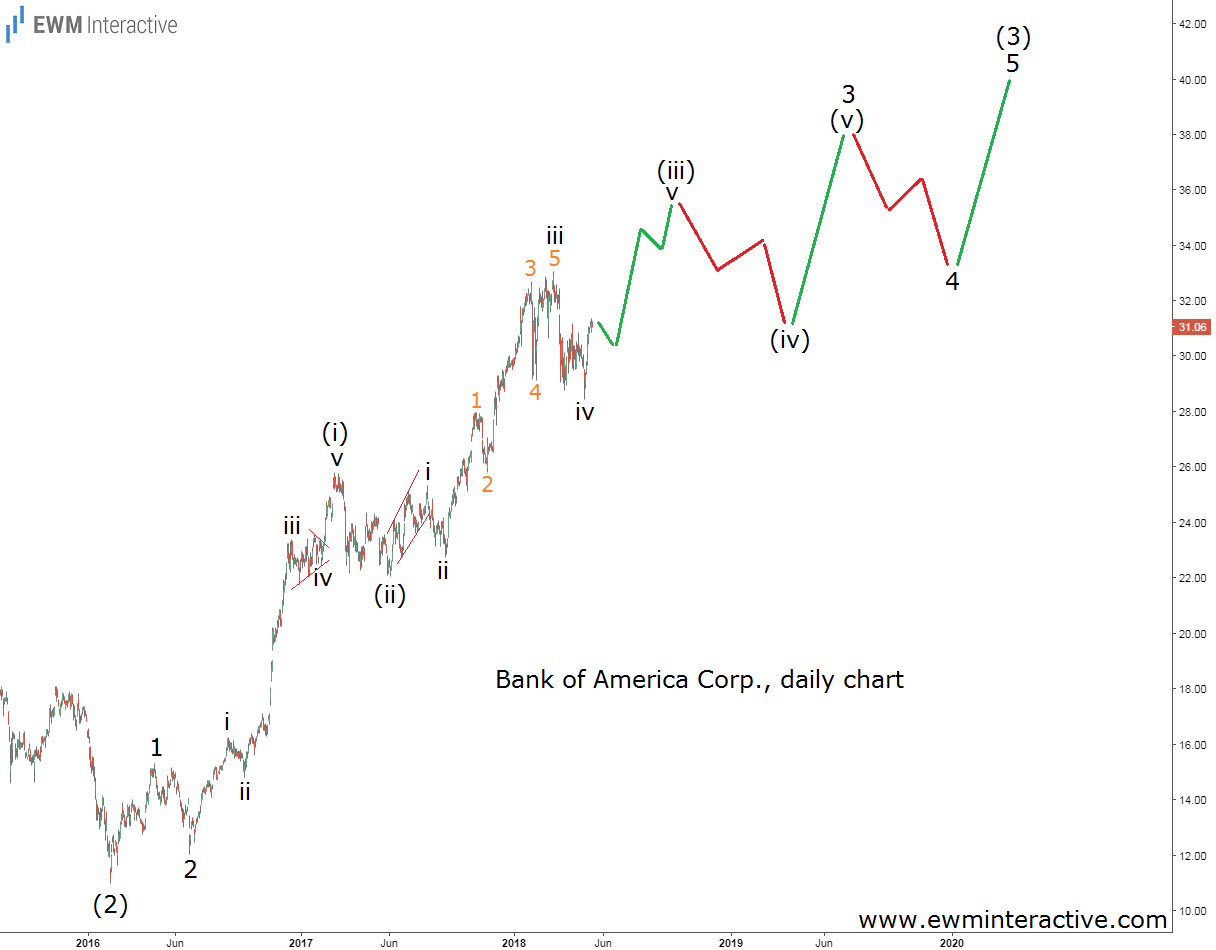

The daily chart shows the entire advance from as low as $10.99 in February 2016 to $33.05 in March 2018. As BAC stock closed slightly above $31 yesterday, the wave structure of the uptrend suggests the bulls still have plenty of room to run. It appears wave “v” of (iii) of 3 is now in progress, meaning a new multi-year high near $34 could soon be expected. $40 a share is there for the taking in the long-term. However, given that a series of fourth and fifth waves should now start to develop, Bank of America (NYSE:BAC) is unlikely to climb as fast as it has been in the last two years. Patience will be required.

Disclosure: The author holds a long position in BAC stock.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.