Trump slaps 30% tariffs on EU, Mexico

Preparing for launch

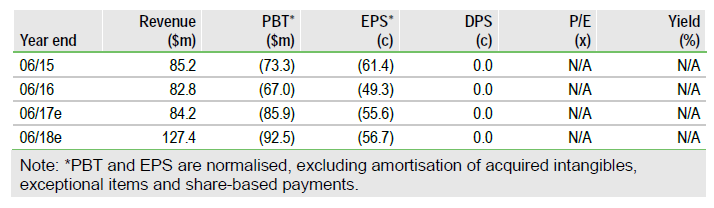

Following the success of the consent solicitation announced on 6 January, Avanti Communications Group's (LON:AVN) refinancing is now complete. The company can pursue the strategic development of its satellite network, increasing revenue and cash flow potential. While lower guidance and the refinancing dilute previous cash equity valuations, a significant opportunity for shareholder value creation remains. Our reinstated and revised forecasts produce a current DCF-based fair value standing at 109p per share.

Funding facilitates model development

The completion of the bond refinancing on 27 January 2017 enables the company to pursue its business model. A better outcome than some had surmised, this also retains potential for longer-term equity value creation for investors from much depressed levels. The $242m of new liquidity will allow the two new Ka-band satellites, HYLAS 3 and HYLAS 4, to be completed, launched and entered into commercial service barring any technical hitches. As capital spending declines, cash flow should increase to service the higher interest costs and ultimately generate cash for equity investors. While the lengthy strategic review and formal sales process compounded uncertainty and inhibited new business wins, customer confidence should now return, reversing this trend.

To read the entire report Please click on the pdf File Below