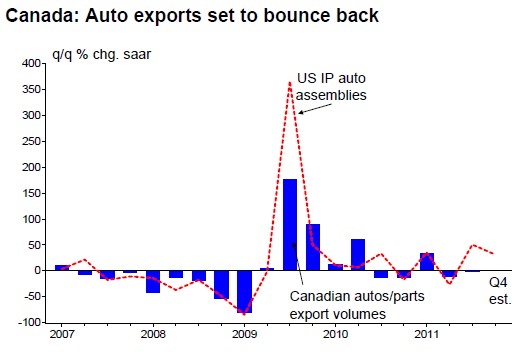

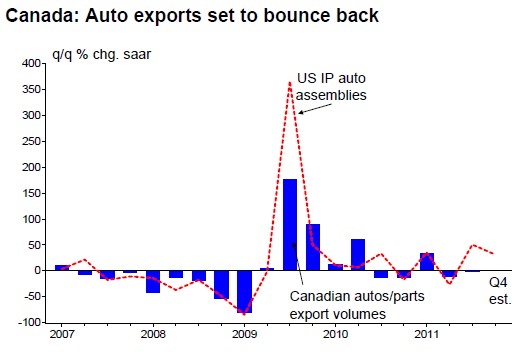

While Europe is sinking into recession, things seem much better on this side of the Atlantic. Canada and the US seem destined for third quarter growth well north of 2% annualized, and early readings for October suggest that momentum carried through to Q4. The strong industrial production data in the US bodes well for Canada too. The IP data showed auto assemblies rising 6.5% in October, which puts US auto production on track for quarterly growth of 32% annualized.

As today’s Hot Chart shows, the tight correlation between US auto assemblies and Canadian auto exports suggest the latter will likely get a sizable boost in the final quarter of the year.

The better-than-expected US economy and the good contribution from trade, suggest a lot of upside to the Bank of Canada’s forecast of 0.8% annualized for Q4 Canadian GDP growth. In our view, the second half of the year should be better than the first half in terms of growth in Canada.

As today’s Hot Chart shows, the tight correlation between US auto assemblies and Canadian auto exports suggest the latter will likely get a sizable boost in the final quarter of the year.

The better-than-expected US economy and the good contribution from trade, suggest a lot of upside to the Bank of Canada’s forecast of 0.8% annualized for Q4 Canadian GDP growth. In our view, the second half of the year should be better than the first half in terms of growth in Canada.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI