by Kevin Davitt

I believe the risk vs potential reward of being long the Aussie dollar is skewed the right way at present.

The Currency markets have been particularly volatile since the JPY/USD broke par on Thursday at 1pm Chicago time.

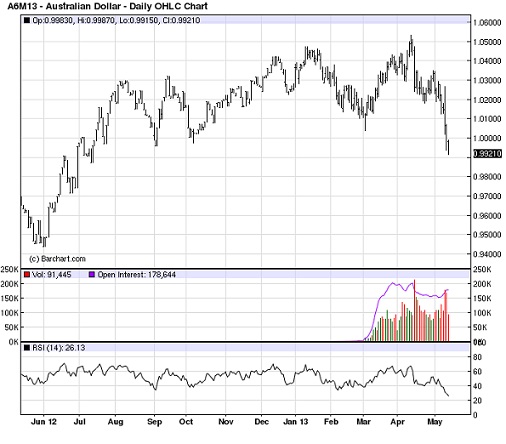

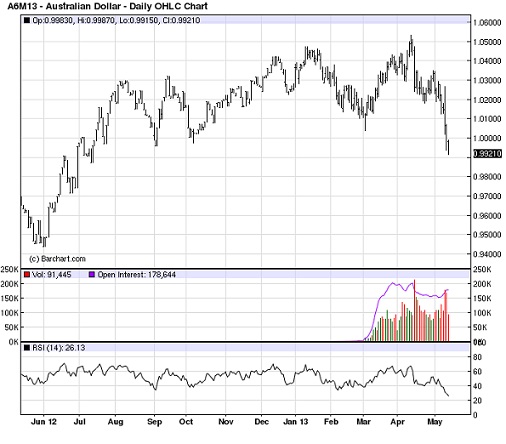

I would advocate for a Long future in the Aussie dollar (ADM13) at 99.20 based on technicals (it appears oversold) as well as my belief that the Energies/Metals are likely to be well supported via easy global monetary policy). The Royal Bank of Australia cut rates to 2.75% last week which is interpreted as a sign of spreading weakness from China.

I would recommend a STOP at 98.50 which is below the August 2011 lows (following the US Debt downgrade).

Risk (not including frictional costs) would be $700.

Target an exit at 101.00. In essence, 2.5 to 1 on risk. ($700 v. $1,800).

Option types could consider SELLING the WEEK 4 (May 24th expiration) 98.50 puts for 45 ticks. Collect $450 less frictional costs. Risk a "synthetic" long future at ~ 98.05. Trade around that position post expiration.

Shorter term look at the chart:

The last time the Aussie was 99.20 - the S&Ps were 300 points lower. Perhaps an unfair comparison, but if China comes off the rails (which I don't believe happens with their form of "controlled/massaged Capitalism") then everyone suffers.

I believe the risk vs potential reward of being long the Aussie dollar is skewed the right way at present.

The Currency markets have been particularly volatile since the JPY/USD broke par on Thursday at 1pm Chicago time.

I would advocate for a Long future in the Aussie dollar (ADM13) at 99.20 based on technicals (it appears oversold) as well as my belief that the Energies/Metals are likely to be well supported via easy global monetary policy). The Royal Bank of Australia cut rates to 2.75% last week which is interpreted as a sign of spreading weakness from China.

I would recommend a STOP at 98.50 which is below the August 2011 lows (following the US Debt downgrade).

Risk (not including frictional costs) would be $700.

Target an exit at 101.00. In essence, 2.5 to 1 on risk. ($700 v. $1,800).

Option types could consider SELLING the WEEK 4 (May 24th expiration) 98.50 puts for 45 ticks. Collect $450 less frictional costs. Risk a "synthetic" long future at ~ 98.05. Trade around that position post expiration.

Shorter term look at the chart:

The last time the Aussie was 99.20 - the S&Ps were 300 points lower. Perhaps an unfair comparison, but if China comes off the rails (which I don't believe happens with their form of "controlled/massaged Capitalism") then everyone suffers.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.