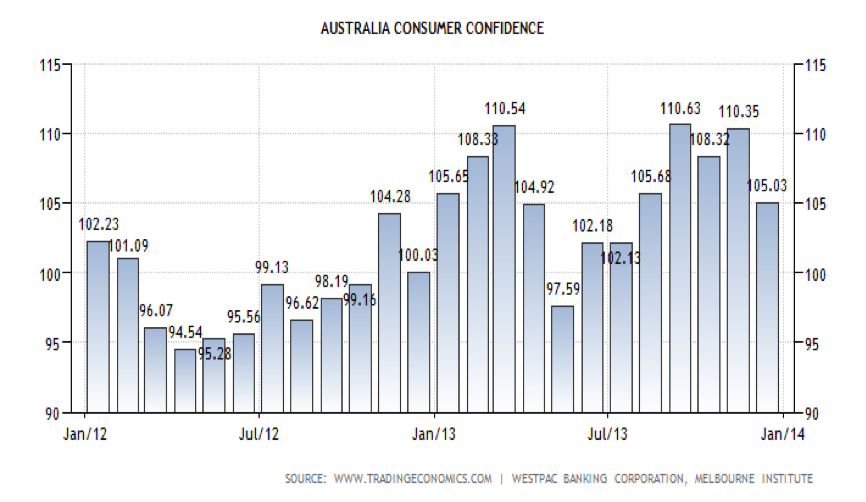

Consumer confidence in Australia fell to 105.03 in December, 2013, from 110.35 in November of 2013.

A further fall to around 104.65 is forecast. However, I’m not so certain for the following reasons: acting treasurer, Mr. M. Cormann, has cited better-than-expected retail trading figures and housing (approval) data as evidence that consumer confidence is picking up in the Australian economy. Retail trade increased by 0.7% in November, the fourth rise in a row.

The value of housing approvals was $7.82bn, increasing by $1.45bn (for the month), 22.2% from a year earlier.

“These are all positive indications that consumers are growing more confident in the direction of the Australian economy,” Senator Cormann said in a statement on Thursday. However, he warned the economy was growing below trend while unemployment was too high and trending upwards.

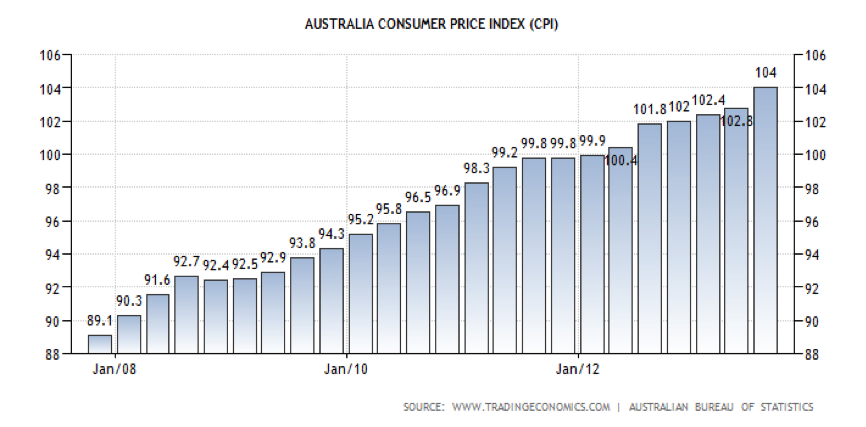

Consumer price index increased to 104 Index Points in the third quarter of 2013, from 102.80 in the second quarter of 2013. Significant price rises in the September quarter were as follows: automotive fuel (7.6%); international holiday travel and accommodation (6.1%); electricity (+4.4 percent); property rates and charges (7.9%) and water/sewerage (9.9%). The most significant price fall was for vegetables down by 4.5%, a seasonal variation.

The forecast comes in at 103.69.

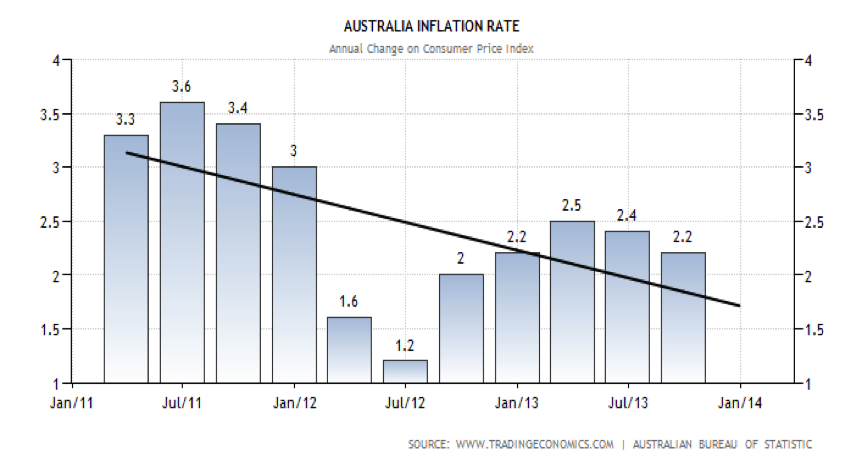

On Wednesday we shall see the Inflation Rate figures released, which have been trending down from 2011 onwards.

The forecast is 2.25% (year on year), a 2.5% increase. In his last 2013 public appearance, Mr. Stevens suggested that the AUD should be below the 0.90000 line vs. the USD. However, he also mentioned his opinion that interest rate increases do not drive growth. This will cause tension in the markets should the inflation data show a fall, driving down the AUD.

Overall the data forecasts for Australia seem positive so far and with China issuing data which supports the AUD, with respect to commodity demand, it seems likely that the AUD will regain some of its strength in the near future. However, a close eye should be kept on policy as this is likely to be in direct opposition to a strongly rising AUD.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.