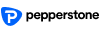

US equity markets continue to grind higher, and there seems little doubt that the falls we see in implied volatility, in all asset classes, are promoting further buying in equities. Specifically, funds that target volatility and dictate how invested they can be have been on fire of late. As the S&P 500 and NASDAQ resume their bullish trends, the rules of the system mean that they need to be more involved in the equity market.

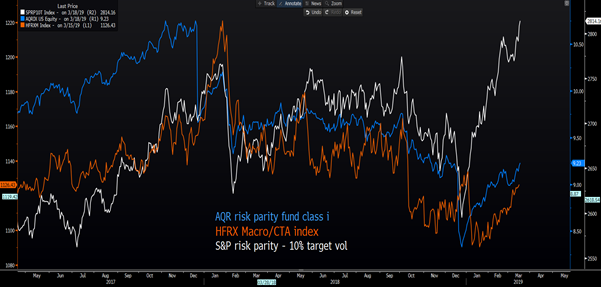

We can see from the fund flow that investors have been increasing exposures to equities again, where we can look at the ETF market and the ishares S&P 500 (NYSE:IVV) and see massive inflows last week (see the green histogram), where notably this came at the break of strong horizontal resistance at 2820. With the VIX index (30-day implied volatility in the S&P 500) sitting at 13.1% and some way below the year-to-date average of 16.95%, implied vol is seemingly one of the critical factors causing higher equity prices.

Further to that, and as I have detailed of late in recent notes falling ‘real’ US Treasury yields have been key here, as lower yield boosts the appeal of future corporate cash flows and makes equity ever more attractive. While future easing from central banks, identified in the interest rates market, has also helped suppress volatility (vol) and vol sellers have rejoiced at the belief that the world’s important central banks will not let financial conditions affect economics. We have moved on from the ‘Powell put’, to a united global central bank ‘put’ and to where central banks have the markets backs.

The theory of low vol is something that we as FX traders have become quite accustomed too of late, and at this juncture, we see the Deutsche FX volatility index at the lowest levels since September 2014. Its no surprise then that implied volatility in the bond market approaching the lowest levels on record and traders have been closing short US Treasury positions at a rate of knots.

Implied and realised volatility define our strategy; it inspires a hunt for yield (in all asset classes), or it can promote a de-risking of portfolios with traders piling into the JPY or CHF. Volatility is the crucial consideration for how much risk we take on every position and this effects our position sizing, which is essential to all successful traders.

Will Thursday’s FOMC meeting be a volatility event?

With the low vol environment in mind, it segways nicely into Thursday’s FOMC meeting, and there is little doubt Jay Powell and co would be liking what they see. On the one hand, Q1 GDP may be tracking between 0.5% and 1%, and trending downwards. However, in a land of economic uncertainty all is not lost, with composite ISM, the retail sales control group, wages and unemployment all providing hope. The Fed also recognise the linkage between broad financial conditions and improving economics and will be keen not to rock the boat.

In fact, given the trend to a more dovish shift from the likes of the ECB, one would argue it set us up for the Fed to follow their lead. This opens the door to an announcement on the end of the balance sheet normalisation program (known as QT or Quantitative Tightening), which would keep the gravy train in risk motion, given many still feel this announcement comes in the months ahead. A shift in the ‘dot plot’ projections to show the median estimate is now for no hikes in 2019 would also be a risk positive. It's these two considerations that the algo’s will most sensitive too, and it’s here we will see the likes of the USD, bonds and S&P 500 respond.

The FOMC meeting is a risk to exposures, with the more significant reaction coming from a Fed who leave one hike on the table for 2019, seems relatively upbeat in their commentary and looks to leave an announcement of QT for a later meeting. The fact that 21bp of cuts are priced for 2020 suggests that the commentary has to be sufficiently dovish enough to meet this dovish pricing, or the USD will find buyers driven by a sell-off across the US Treasury curve.

There have no discernible trends from our flow today, and that is a function of modest moves across Asia. The ASX 200 has been oscillating around the flatline, but now China is up and running we will likely track this more intently into the close, as we did yesterday. While down smalls today, on the daily timeframe, the Chinese equity markets are looking strong and looking set for another charge higher – one to watch, so put the CN50 index on the radar.

AUD/USD holding 71c

AUD/USD is holding on the 71-handle quite well considering the dynamics unfolding in the Aussie bond market. I would hesitate to say today's RBA minutes had a huge bearing on sentiment given they pre-dated the poor Q4 GDP print (+0.2% QoQ). However, the fact we can see Aussie front-end yields tracking a touch lower on the day, with the 3-year Treasury momentarily trading -3bp and momentarily trading below 1.5% - the RBA cash rate, is keeping the AUD buyers at bay. It seems the bond market is eyeing a passage in the minutes that states members ‘had a detailed discussion of the Bank's operations in repurchase and foreign exchange swap markets and their role in achieving the Board's target for the cash rate.' The bond market likes the fact that the RBA is at least having discussions on quasi easing.

With Aussie swaps markets pricing 43bp of cuts over the coming 12 months, perhaps this is sufficiently rich enough for the stage to be set for a slight rebound into 72c. However, for that, we’ll need to see a dovish Fed, a solid Aussie jobs report (on Thursday) and further gains in the Chinese equity markets. I would argue that the RBA minutes put the emphasis on the labour market, so Thursday jobs report could be quite important for the AUD.

Brexit shenanigans

We’ve also seen the mixed flow on GBP/USD, and GBP crosses, which is no surprise as the move from House speaker Bercow to pull the third Meaningful Brexit vote hardly makes life easier for FX traders. Trading aside, I am sure the moves would have absolutely infuriated Theresa May though, as her plan all along was to push this to the wire and convince enough pro-Brexit MPs to feel this was as close to a Brexit separation as they will ever get. But, in the eyes of many, it has removed the inevitable that a vote tomorrow would have likely failed, even if it was going to be far closer.

The focus, therefore, falls on the EU Council meeting on Thursday and Friday and whether the EU firstly accept May’s speculated request for a six to nine-month extension, or if the duration proves to be closer to 12-24 months. The fact GBP/USD is supported in 1.32 suggests the market feels that on balance the removal of the third vote takes us to where we would have been anyhow, and no one is prepared to act aggressively here. Once the EU offer their proposal of an extension and the UK accept then we are back to assessing the probability of a second referendum, a new election or an actual deal. The circus rolls on.