Talking Points

- AUD/JPY testing key near-term resistance confluence- immediate long bias at risk below

- Updated targets and invalidation levels

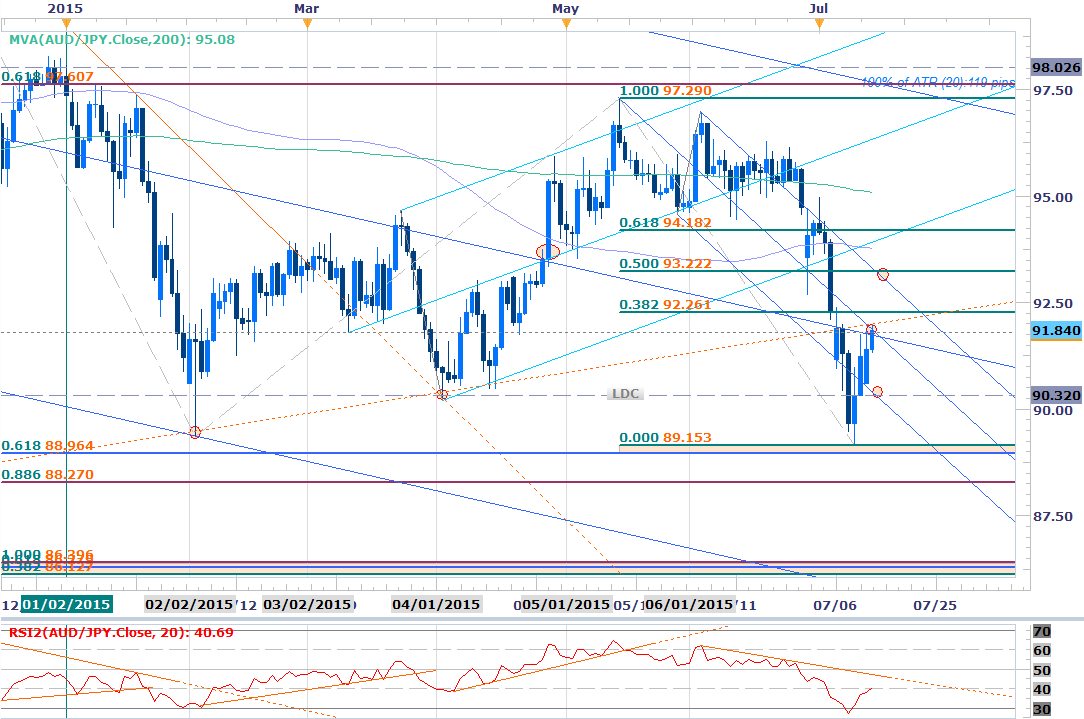

AUD/JPY Weekly

AUD/JPY Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- AUD/JPY approaching resistance confluence ahead of 92.00

- Breach targets 92.26 and the upper median-line parallel / 93.22

- Broader bearish invalidation at 94.18

- Support at 90.32 backed by 88.96-89.15 & 88.27

- Daily RSI approaching 40 resistance- Pending resistance trigger in play

- Event Risk Ahead: China 2Q GDP & BoJ tonight

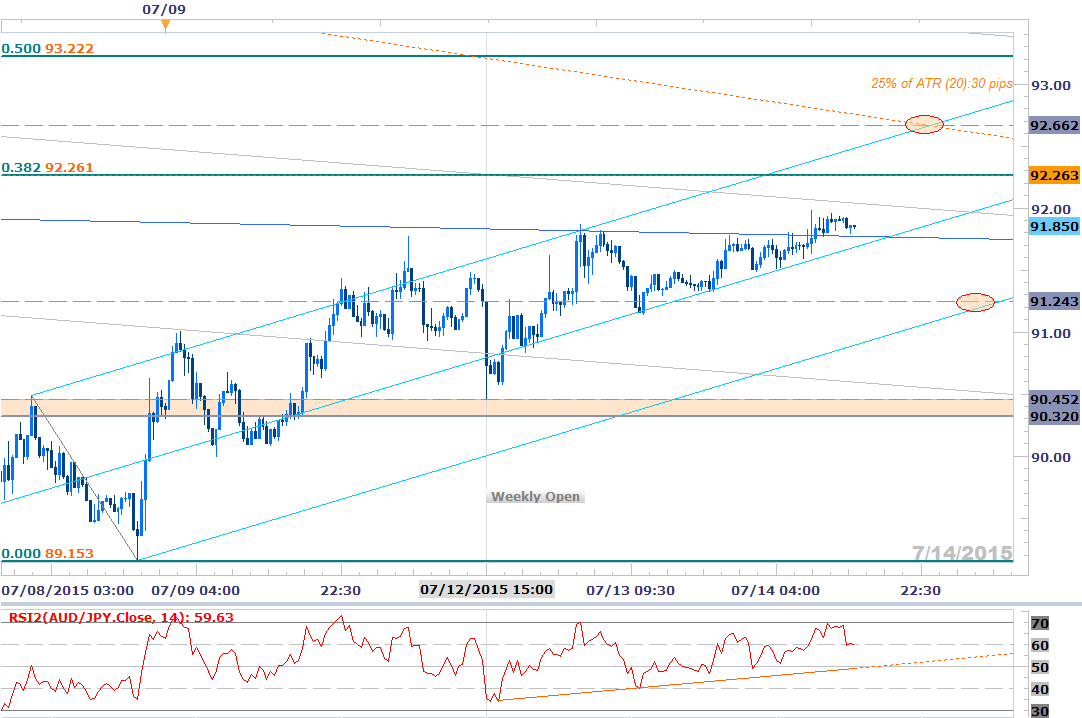

AUD/JPY 30min

Notes: AUD/JPY has been trading within the confines of a well-defined ascending median-line formation off last week’s lows with the rally now approaching former daily support turned resistance. The rally is at risk here near-term sub-92, but the trade remains constructive while within this formation with a breach higher targets objectives at 92.26, 92.66 and 93.22.

Interim support rests at Friday’s close at 91.24 backed by the lower MLP (bullish invalidation). A break below looks for more significant support at 90.32/45 which is defined by the weekly low and the 2015 low-day close. A quarter of the daily average true range yields profit targets of 29-31pips per scalp. Event risk from the respective economies is somewhat limited but be on the lookout for the BoJ and China data tonight with the releases likely to fuel added volatility in risk sensitive pairs.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI