TSMC Q2 sales jump 39% on robust AI-driven chip demand

The AUD/USD has moved very well over the last week or so as it has finally shown some positive signs, moving from three year lows to move back above the key level of 90 cents and further to a two week high just above 0.92 to finish out last week. In the week prior, it fell very strongly and appeared to resume the medium term down trend as it moved to a new three year low near 0.8850 but it has reversed very well since, and now looks poised to continue back towards the longer term resistance level at 0.93. It was only a few weeks ago the AUD/USD moved up towards the 0.93 level again as it continued to place buying pressure on that level. It was during this time it did very well to maintain its price level well above 0.92 as it placed upward buying pressure on the resistance level at 0.93. However, a few weeks ago it fell sharply to back under 0.92 and started to place pressure on the short term support level of 0.9150.

Over the course of the last month or so the 0.93 level has provided reasonable resistance to any movement higher and this level will likely play a role again should the AUD/USD continue its rally up above 0.92. Throughout July, the AUD/USD spent most of its time trading between 0.90 and 0.93, threatening to break through either level at multiple stages. The 0.9150 level also became a key level during that time, providing both some resistance and more recently support, and this was called upon again a few weeks ago providing some much needed support, however it was completely ignored a couple of weeks ago as the AUD/USD fell heavily through it. It was only a month or so ago that many were waiting for the AUD/USD to break below the 90 cent level and then it would have been a matter of how far can it drop. It had continued to drift lower and move towards the 90 cent level, a level not seen for three years. Considering the speed of its decline over the last few months, the last month or so had seen a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 and made its way back to 0.93 on a few occasions.

The last few months have seen the AUD/USD establish a strong medium-term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time. In doing so, it has completely ignored any likely support at previous key levels at 1.04, 1.0360 and 1, and more recently the long term support level at 0.97. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. After making a solid run higher in the middle of June, back towards the key level of 0.97, the AUD/USD has since continued its strong and steady decline moving to below 0.90 and levels not seen since near the middle of 2010. This has seen it experience a significant strong trend that would have caught many people on the wrong side of.

Australia’s unemployment rate remained steady at +5.7% last month, but the number of people employed dropped by -10.2k in July compared with median estimates of +5k. The number of full-time jobs declined by -6.7k and part-time jobs fell by -3.5k on the month. Even more disappointing was the participation rate, dropping to 65.1% in July from 65.3% in June. China’s imports rising +10.9% on the month is good news for the Aussies. They managed to post record exports of both coal and iron ore to its largest trading partner. The newfound currency’s belief may well depend on the extent to which the RBA lowers its economic growth forecasts in its quarterly statement on monetary policy, released tomorrow.

AUD/USD August 11 at 23:45 GMT 0.9187 H: 0.9206 L: 0.9175

During the early hours of the Asian trading session on Monday, the AUD/USD is brushing up some resistance at 92 cents after finishing out last week just pushing ever so slightly higher through there. Despite its slowing and slight recovery the last few weeks, the Australian dollar has been in the middle of a free-fall, as the currency has lost around 15 cents since the beginning of May. In moving through to 1.0580 only a few months ago, it moved to its highest level since January. Current range: trading just below 0.9190.

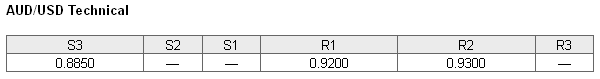

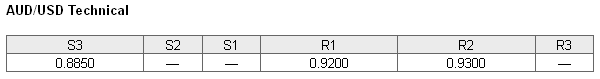

Further levels in both directions:

• Below: 0.8850

• Above: 0.9200 and 0.9300

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has eased back under 70% as the Australian dollar has rallied back above 91 cents. The trader sentiment remains in favour of long positions.

Economic Releases

Over the course of the last month or so the 0.93 level has provided reasonable resistance to any movement higher and this level will likely play a role again should the AUD/USD continue its rally up above 0.92. Throughout July, the AUD/USD spent most of its time trading between 0.90 and 0.93, threatening to break through either level at multiple stages. The 0.9150 level also became a key level during that time, providing both some resistance and more recently support, and this was called upon again a few weeks ago providing some much needed support, however it was completely ignored a couple of weeks ago as the AUD/USD fell heavily through it. It was only a month or so ago that many were waiting for the AUD/USD to break below the 90 cent level and then it would have been a matter of how far can it drop. It had continued to drift lower and move towards the 90 cent level, a level not seen for three years. Considering the speed of its decline over the last few months, the last month or so had seen a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 and made its way back to 0.93 on a few occasions.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The last few months have seen the AUD/USD establish a strong medium-term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time. In doing so, it has completely ignored any likely support at previous key levels at 1.04, 1.0360 and 1, and more recently the long term support level at 0.97. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. After making a solid run higher in the middle of June, back towards the key level of 0.97, the AUD/USD has since continued its strong and steady decline moving to below 0.90 and levels not seen since near the middle of 2010. This has seen it experience a significant strong trend that would have caught many people on the wrong side of.

Australia’s unemployment rate remained steady at +5.7% last month, but the number of people employed dropped by -10.2k in July compared with median estimates of +5k. The number of full-time jobs declined by -6.7k and part-time jobs fell by -3.5k on the month. Even more disappointing was the participation rate, dropping to 65.1% in July from 65.3% in June. China’s imports rising +10.9% on the month is good news for the Aussies. They managed to post record exports of both coal and iron ore to its largest trading partner. The newfound currency’s belief may well depend on the extent to which the RBA lowers its economic growth forecasts in its quarterly statement on monetary policy, released tomorrow.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

AUD/USD August 11 at 23:45 GMT 0.9187 H: 0.9206 L: 0.9175

During the early hours of the Asian trading session on Monday, the AUD/USD is brushing up some resistance at 92 cents after finishing out last week just pushing ever so slightly higher through there. Despite its slowing and slight recovery the last few weeks, the Australian dollar has been in the middle of a free-fall, as the currency has lost around 15 cents since the beginning of May. In moving through to 1.0580 only a few months ago, it moved to its highest level since January. Current range: trading just below 0.9190.

Further levels in both directions:

• Below: 0.8850

• Above: 0.9200 and 0.9300

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has eased back under 70% as the Australian dollar has rallied back above 91 cents. The trader sentiment remains in favour of long positions.

Economic Releases

- 23:50 (Sun) JP GDP (Prelim.) (Q2)

- 04:30 JP Capacity Utilisation (Jun)

- 04:30 JP Industrial Production (Final) (Jun)

- 18:00 US Budget (Jul)

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI