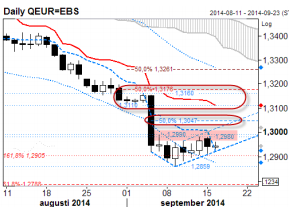

EUR/USD: Respecting resistance or not?

Sellers were noted at local 1.2980/90 resistance yesterday. A level that needs to be broken to call for a 'V-shaped low' in place and reason to lift attention towards 1.3047 first and secondly to the 1.3110/76-area. A sustained move below 1.2908 would on the other hand question this and argues for focus back on the recent 1.2859 low.

GBP/USD: The weekend gap is still open.

Sellers reacted at the low end of the still open gap over the weekend before last. Short-term conditions are stretched but pre-Scottish referendum pressure on the pound is still on. If this gap is closed (in the drive to reduce the downside stretch), there would anyway be more resistance to deal with at 1.6395/1.6456. A move below support at 1.6205/16185 would add a near-term 'Round-top' targeting 1.6130. Current intraday stretches are located at 1.6175 & 1.6290.

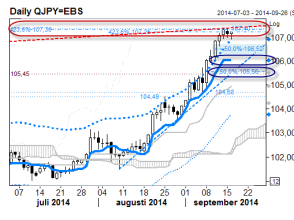

USD/JPY: Time to do something the stretch.

Short-term conditions are still stretched. A number of objectives have been reached and price action has become more two-sided over the past few sessions. Loss of support at 106.93 (& later 106.65/52) would be reason to shave off some excessive longs and correctively target 106.04/105.56. Current intraday stretches are located at 106.80 & 107.55.

AUD/NZD: Down at first Fibo support.

After last week's bearish engulfing candle the market has also begun the current week in a negative mode. We are now approaching the first major hurdle, the 1.1018 equality point. If the decline merely is a downside correction, which we don't think it is, it will end around 1.1018. Our primary view is that we've just ended a nine month long upside correction and that the re-entrance of the slowly rising channel imposes a huge downside threat. The bounce from 1.1018 will probably not go higher that 1.1180 and should be seen as a selling opportunity.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI